The Memes Make the Bitcoin

Bitcoin is groundbreaking because it solved the issue of coordinating consensus across a decentralized network full of adversaries. However, as a protocol, Bitcoin only solved the problem of automated machine consensus. There is still the issue of human consensus in meatspace, as the network only represents the rules to which its human operators agree to enforce.

People have been trying to understand how Bitcoin "governance" works for years; exploration of this subject really took off during the height of scaling debates in 2016 / 2017. My view is that the system evolves via bottom-up building of consensus amongst its human participants. The metaphor of Mycelium fits well:

Why is this the case? There's a theory that money is a sophisticated subjectivist ontology:

Money is anything (physical or non-physical) that humans are collectively willing to represent and intend to function as a medium of exchange, store of value and unit of account.

Obviously there are some things that will work better for these purposes than others, as Nick Szabo explains in Shelling Out. Scarce collectible items such as precious metals have done a pretty good job acting as money for thousands of years. Eventually fiat money came along and the characteristics of money were dictated to us by kings, congresses, and central banks.

But now Bitcoin has changed the game. No longer are we limited to choosing physical collectibles based on unchangeable physical characteristics. No longer are we restricted to accepting the characteristics of what the authorities make available. Now we have a system that is an open collaborative project; a system of rules without rulers.

Ultimately the point of meatspace consensus / governance is to continue to answer the question of "what is Bitcoin?" As long as this system continues to evolve, its human participants will need to discuss what changes are "good" and fit the ethos of the project while also determining what proposed changes are "bad" and are not a good fit because they require trade-offs that harm desired attributes for the system to maintain.

As Nic Carter shows, the most propagated visions of "what Bitcoin is" have constantly been in flux since its inception. They change as we learn more about how the system operates, how it can be changed, and as new narratives are formed that are a better fit.

Bitcoin narratives help reinforce its important attributes. Bitcoin is a living organism that must fight off invaders who seek to weaken it from within via mind viruses. Narratives are the white blood cells that fight against changes that would result in degradation of valued properties. Narratives are propagated via memes.

This is essentially our observation of Meme Theory at work. While the rest of this post will cover many catchy memes, the point is not the memes themselves but rather how they affect cultural information transfer and thus the "governance" of Bitcoin. Detractors have called this "proof of social media" because they prefer to have a simpler, more quantifiable form of governance such as hashrate voting. Somewhat ironically, these detractors have forked off to their own networks not via hashrate voting, but via formation of their own memes to convince users to run software that enforces different protocol rules.

The following are three dozen of the most commonly uses memes in Bitcoin. You can find far more at bitcoinmemes.info.

Fundamental Principles

"Don't trust, verify."

This saying can be traced back to the whitepaper itself; it is the primary principle underpinning the creation of the entire system. Anyone who wishes to introduce trust as a requirement to the system is putting the entire system in danger of collapse.

“The root problem with conventional currency is all the trust that’s required to make it work. […] What is needed is an electronic payment system based on cryptographic proof instead of trust” - Satoshi Nakamoto

"Not your keys, not your coins."

An extension of "don't trust, verify" - don't trust third parties with your private keys. Most of the catastrophes that have occurred in the cryptocurrency space have been a result of trusted third parties accumulating vast sums of value and then mismanaging them.

Bitcoin Sign Guy

Another fundamental principle of Bitcoin is auditability. As the Chairman of the Federal Reserve was explaining why The Fed should not be audited, a member of the audience flashed a hastily written sign recommending how viewers could fight back.

Run the Numbers

It’s great to talk and write about decentralization.

— pierre rochard (@pierre_rochard) August 10, 2020

But it’s not enough.

You have to actually run the software yourself.

You have to do the math yourself.

You have to run the numbers yourself.

In 2020 Pierre Rochard embarked upon a campaign to try to audit the supply of ETH in order to show how hard it is to audit in comparison to Bitcoin. It didn't go very well, as different auditors who wrote scripts ended up with different results.

In Math we Trust

Bitcoin is a protocol that is fundamentally secured by cryptography, which is just math. Rather than trusting in some authority to keep the system stable, we rely upon science.

Nocoiners: Bitcoin is like a weird religious cult.

— Kay Kurokawa (@kaykurokawa) February 19, 2019

Dollar Bill: pic.twitter.com/PTMqRzMzGH

Price Volatility

The Bitcoin Rollercoaster

Once you start holding BTC, you're in for a hell of a ride. You might as well strap in and enjoy it; if owning bitcoin causes you anxiety then you're not ready for it or have invested too much money.

"1 BTC = 1 BTC"

Watching fiat exchange rates can be stressful; it's easier to manage when you remember that your ownership stake in Bitcoin as a whole is not changing.

If you allow yourself to be excited about bitcoin's exchange rate then you set yourself up to be disappointed about bitcoin's exchange rate. The zen hodler finds solace in the tautology that 1 BTC = 1 BTC.

— Jameson Lopp (@lopp) May 12, 2019

Hype Cycles

Your first ride through a full hype cycle will be thrilling on the way up and scary on the way down; once you've experienced several cycles the effects are dampened.

#Bitcoin Market Cycle pic.twitter.com/WOpARtWvVs

— Rob DaRock (@CryptoDaRock) February 4, 2018

HODL

I AM HODLING was a drunken rant posted on the bitcointalk forum in December 2013. It's essentially a rant against trading; the poster knows he is a bad trader and will likely end up with fewer bitcoins if he tries to time the market. He sums it up well:

In a zero-sum game such as this, traders can only take your money if you sell.

Note: HODL does NOT stand for "Hold on for Dear Life" - that's just a backronym. While HODL is often meant as "don't panic sell" it also refers to the idea that if you're investing in bitcoin it should be for a long timeframe rather than for day trading.

Timing the Market

The market never does what you want it to do; if you're investing for the long term then it ultimately won't matter much if you manage to buy for a few percent less than the current exchange rate.

Understanding Bitcoin

Digital Gold

Likely one of the most succinct ways to describe the myriad of properties exhibited by the system; most people understand gold and they understand that the internet lets you send information quickly.

Internet of Money

The first step of understanding bitcoin is as a new type of money. The second step is learning how it can do far more than just store and transfer value.

#Bitcoin introduces a platform on which you can run currency as an application, on a network without any central points of control. This is not money for the internet, but the internet of money. https://t.co/lwNsq0Oh1f

— Andreas ☮ 🌈 ⚛ ⚖ 🌐 📡 📖 📹 🔑 🛩 (@aantonop) January 14, 2018

📙 https://t.co/XTrmA8olSP

Be your own Bank

By getting rid of the need for trusted third parties you can now store and send your money without the need of a bank. By being your own bank you can access your money 24/7/365 without having to ask permission from anyone.

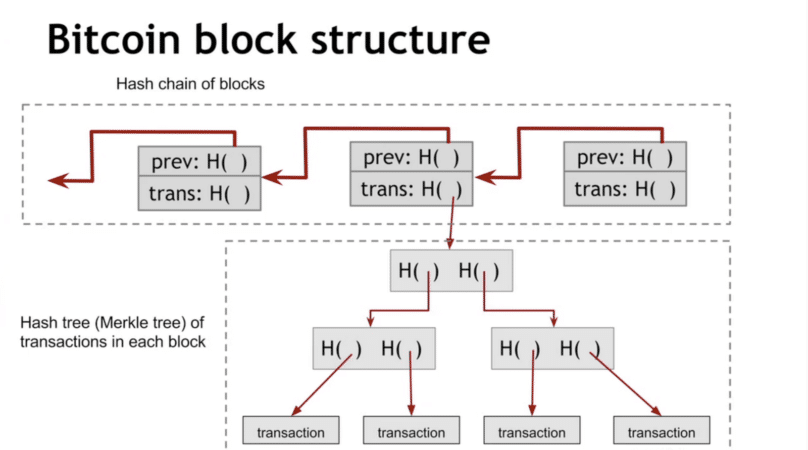

Money grows on Merkle trees

This is a twist on the common phrase of "money doesn't grow on trees." When it comes to bitcoin, all transactions get aggregated into a cryptographic structure called a Merkle tree; the root hash of the Merkle tree with all of the transactions confirmed in a block gets stored in the block's header. As such, every bitcoin (UTXO) in existence was added to a Merkle tree when it was created.

Magic Internet Money

In February 2013, Bitcoin subreddit moderator /u/theymos created a thread asking the community to submit ideas for a Reddit ad for /r/bitcoin. Within an hour of the request, /u/mavensbot introduced to the world an MS Paint drawing of the Magic Internet Money Wizard. Little did they know the influence it would soon have in growing the subreddit and becoming the most popular Reddit ad ever. This is a fun way to describe Bitcoin that glosses over all of the technical details.

Bitcoin Fixes This

The attributes of Bitcoin as a system make quite a few things impossible in Bitcoin that you see happen often in the traditional system. Generally this is due to the difficulty of manipulating Bitcoin as a system. The formula for this meme is simple: explain a problem in the current system that Bitcoin protects against, then end with "Bitcoin fixes this."

If you have debt, value is stolen from you as interest.

— wiz (@wiz) December 7, 2019

If you have savings, value is stolen from you as inflation.

If you have assets, value is stolen from you as taxation.

Simply by being unconfiscatable, Bitcoin Fixes This. Now everyone can accumulate wealth by stacking sats.

Potential Long-Term Impact

Bitcoin Citadels

This is reference to the "Bitcoin Time Traveler" post on Reddit in 2013. It painted a bleak picture of a future world in which Bitcoin goes mainstream and essentially destroys the consumption-driven economy. As a result, many early Bitcoin adopters are robbed or lynched; those who survive take protection in fortified Citadels. Some Bitcoiners are already preparing...

Neo / Morpheus

Another meme to help get people out of the mindset of denominating their bitcoin wealth in fiat terms. If Bitcoin goes mainstream to the point that the exchange rate is orders of magnitude higher than it is today, it will be because it is accepted by many people and businesses. As such, you won't need to sell it for fiat; you'll be able to spend it directly. The meme likely originated on this Bitcointalk thread.

Geopolitical Implications

Bitcoin is ultimately about power. It takes power away from being held in the hands of a few elites and distributes it widely, resulting in a system that is incredibly difficult to change without widespread consensus. It is the separation of money and state. It stands to reason that given sufficient adoption, it will force the existing systems to change in order to remain competitive. This is essentially the thesis explained in The Sovereign Individual.

Bitcoin's Robustness

Honey Badger

Bitcoin's distributed nature and lack of single points of failure result in in having a property of antifragility. While there are setbacks from time to time, Bitcoin always bounces back. This resilience has resulted in the unofficial mascot for Bitcoin being none other than the honey badger, which you can see below is a badass little creature.

This is good for Bitcoin

When terrible things befall the traditional system, it's good for Bitcoin because proponents can proclaim "Bitcoin fixes this!" Though some proponents have taken to mixing the robustness of Bitcoin itself into the "this is good for Bitcoin" meme and thus when a terrible event occurs in Bitcoin, it's also "good for Bitcoin" because it is just another display of the network's robustness.

in conclusion this is good for bitcoin

— Edward Snowden (@Snowden) September 17, 2019

Vires in Numeris

I like "strength in numbers" because it's applicable from a variety of perspectives:

- The cryptography securing private keys is based upon large numbers

- The proof of work securing the blockchain against being rewritten is based upon brute forcing the solution to a huge problem space

- The decentralized nature of the network makes it robust against physical attack - there are too many "doors to kick down" for such an attack to be feasible.

The Bitcoin motto "Vires in Numeris" (strength in numbers) was first suggested on the BitcoinTalk forum in May 2011. It became popular after being printed on the Casascius physical bitcoins. pic.twitter.com/egq0BsthFJ

— Tuur Demeester (@TuurDemeester) August 22, 2019

Stay humble and stack sats

This appears to be a modification of a meme from precious metals investors who would stack coins / bars. The point being that as long as you keep accumulating unconfiscatable assets, you're set. Arguing with others about whether or not you're making a smart decision is ultimately irrelevant.

When Moon

It's generally accepted that the long-term exchange rate of bitcoin for fiat will end up at either 0 or an absurdly high number. During periods of volatility you'll see references to the Bitcoin "rocket ship" as the exchange rate goes vertical. Also of note is a novelty account on Reddit, ToTheMoonGuy, who comes out during these bull runs to comment little more than "To the moon!!! ┗(°0°)┛"

Number Go Up

While I'm not a fan of pumping bitcoin based on price (because the system makes no such guarantees) there is a "greed is good" component to adoption. The incentives are aligned so that media and folks with a shallow understanding of the system only pay attention to price swings; when "number go up" it attracts attention of people who may then dive deeper into the fundamental value of the system.

Bitcoin good. Number go up.

— Pierre Roquefort 🧀 (@pierre_rochard) June 16, 2019

Once again, I prefer framing price over the long term rather than short term. The rules of the protocol make no promise about fiat exchange rate, but they do ensure that the value of your holding will not be slowly eroded via inflation, which is practically guaranteed with fiat currencies.

Bitcoin isn't a get rich quick scheme, it's a don't get poor slowly scheme.

— Jameson Lopp (@lopp) September 11, 2019

It's Time for Plan B

Bitcoin is the alternative, an escape hatch from the existing system.

It's time for Plan B. #Bitcoin pic.twitter.com/jZHalolnKc

— Kim Dotcom (@KimDotcom) March 29, 2015

Marketable Attributes

Bitcoin user not affected

By operating outside of the traditional financial system, bitcoin users are protected from risks inherent to that system. Here we see seizure resistant makes bitcoin holders unaffected by socialized losses via haircuts.

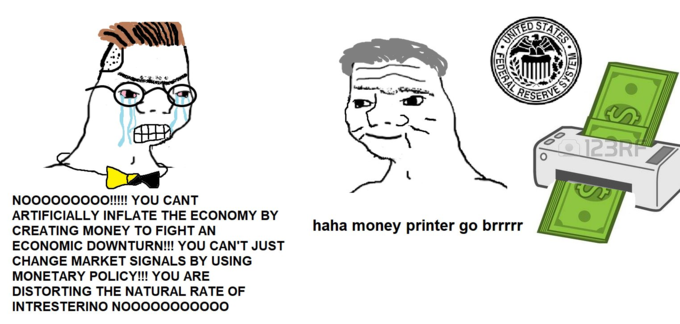

Money printer go brrrr

Central banks will continue to try to "fix" the economy by injecting liquidity whenever there's a crisis; this devalues fiat and should theoretically increase the value of bitcoin relative to fiat.

Purchasing Power

Another reason to HODL for the long term if you believe bitcoin will moon.

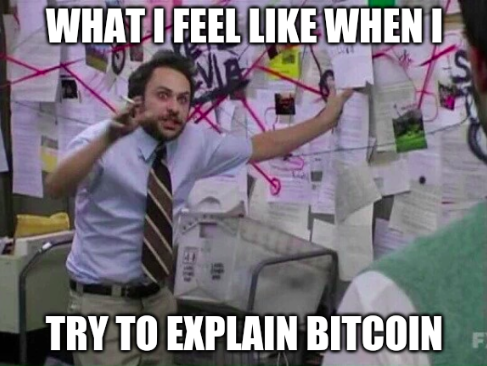

Bitcoin's Complexity

Explaining Bitcoin to newbies is a daunting task, often because it requires diving deeply into what money is and how the current financial system operates. You end up having to explain Keynesian economics, central banking, money creation, and various chokepoints in the system that allow it to be manipulated to the advantage of others. Then you can finally explain why Bitcoin's attributes are superior.

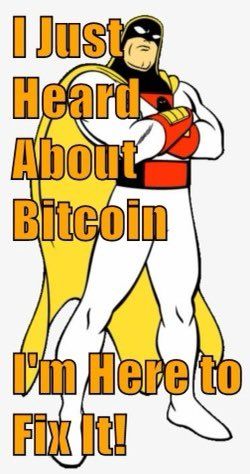

I'm here to fix Bitcoin

Many newcomers find flaws in various attributes of how Bitcoin operates, often not realizing that the flaws are actually features. For example, they may think the low on-chain transaction throughput or the high energy usage for mining will doom Bitcoin to failure, not realizing that these traits actually make it more resistant to various attacks.

In some cases, the most dedicated folks who think they know how to fix Bitcoin end up creating their own cryptocurrency, often by forking Bitcoin and making a small change or two. These experiments tend not to end well.

Inside Jokes

Two Weeks and "soon"

Back in 2012 and 2013, MTGOX was the only bitcoin exchange with any real trading volume. Folks would often ask the CEO when they were going to add support for Litecoin and he'd either respond with "two weeks" or "soon." MTGOX ended up going out of business without ever fulfilling that promise.

18 months

The Lightning Network whitepaper was published in 2015; a year later Lightning Labs was formed. At one point the Lightning Labs CEO said to expect beta software in 18 months. Detractors have taken that quote out of context to proclaim that a fully completely Lightning Network would be finished in 18 months. But the reality is that software is never finished and there is still a lot of building to do.

Lost my coins in a tragic boating accident

Another meme appropriated from both gold investor and firearm culture. This is a pro-privacy joke not to admit you own any assets so that you don't make yourself a target.

THIS IS GENTLEMEN

Similar to "I AM HODLING" this was a typo in a reddit comment that turned into a meme. If the price of Bitcoin rises, this is gentlemen. If the sun shines, this is gentlemen.

The Naysayers

Toxic Maximalism

The term "Bitcoin Maximalist" was actually coined by Vitalik Buterin, the creator of Ethereum. He meant it to be a derogatory term for inflexible, close-minded Bitcoiners but it ended up being adopted by said Bitcoiners and worn as a badge of pride. The roots of the toxicity exhibited by maximalists lie in their defense of Bitcoin's valued attributes. Bitcoin can't be everything to everyone; it would become an unwieldy "kitchen sink" protocol if it tried to cater to everyone's desires.

Have Fun Staying Poor

In September 2020, Udi Wertheimer started replying to anybody who was doing silly DeFi shenanigans to "have fun staying poor." Over the next 4 months he repeated this saying nearly 350 times and eventually created a popular Telegram chat room HaveFunStayingPoor.com. During this period, the retort morphed into something thrown at Bitcoin skeptics who showed themselves to be beyond civil conversation.

There are people among us who truly, genuinely believe, that the future of finance is the creation of a new food token every three days to reward people for pooling funds together for no apparent reason

— Udi Wertheimer (@udiWertheimer) September 15, 2020

Literally people actually think this

Have fun staying poor

Gotta hand it to @udiWertheimer

— Jameson Lopp (@lopp) January 18, 2021

Many lasting memes are instant viral wonders.

Udi appears to have memed HFSP into existence via sheer persistence, having tweeted it nearly 350 times in the past 4 months.

The Flippening

There are plenty of folks who would love to see their favorite cryptocurrency at the top of the market charts. Ethereum has been in second place for many years now and there was hope that it would supplant Bitcoin. It came quite close in 2017 during the peak of ICO mania, but once the flimsy token markets crashed, ETH followed suit.

/https%3A%2F%2Fspecials-images.forbesimg.com%2Fdam%2Fimageserve%2F1088006430%2F0x0.jpg%3Ffit%3Dscale)

Don't buy bitcoin. It's going to crash!

This meme pokes fun at those with a shallow understanding of Bitcoin warn against buying it due to exchange rate volatility. This meme puts the crashes in perspective.

When in doubt zoom out

This appears to be a Reggie Watts quote about his life philosophy that has been adopted by Bitcoiners. It is the same perspective shown in the prior meme, that you should look at the big picture rather than a short window of time.

Swiss Bank Account in your pocket

Obama warned us of the "dangers" of encryption, not realizing that he was effectively touting one of Bitcoin's greatest features.

Professor Bitcorn

One of the loudest detractors in the early days, this professor who testified in front of Congress made the mistake of predicting that bitcoin would fall to nearly $0. He also fell into the "I just learned about Bitcoin and I'm here to fix it" camp by saying it needed inflation.

To the uninitiated, "Prof. Bitcorn" is a satirical reference which is used to refer to academics who predict bitcoin's downfall, or who claim that it needs "fixing". Comes from an op-ed that initially misspelled Bitcoin as "bitcorn". https://t.co/R2A03ClEpO pic.twitter.com/dk8T3QbP6K

— Tuur Demeester (@TuurDemeester) February 23, 2020

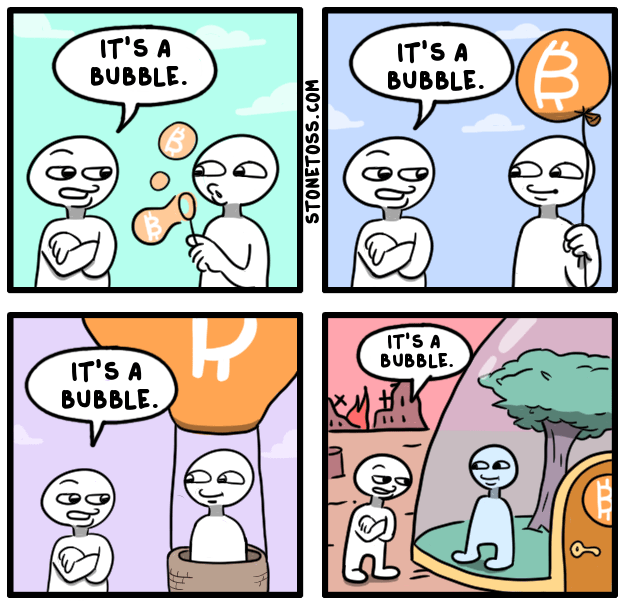

Bitcoin is not the bubble, it's the pin.

While from one standpoint bitcoin is a bubble, any money is a never-ending bubble since it's just based upon a shared agreement of value. If the theses of Bitcoiners hold true, it's the traditional system that will pop while Bitcoin will provide shelter from that collapse.

Laser Eyes

In 2020 an anonymous account started posting photos of folks with laser eyes added; it didn't take long for many Twitter users to update their avatars in solidarity. We even saw Congressmen and Presidents follow suit.

Prepare for battle!#LaserRayUntil100K pic.twitter.com/OFr07gjeBF

— ℂℍ𝔸𝕀ℝ𝔽𝕆ℝℂ𝔼 🦡 (@CHAIRFORCE_BTC) February 16, 2021

Profile picture: Sen. Cynthia M. Lummis (R-WY) campaign account "CynthiaMLummis"https://t.co/HkFl3ydBNz => https://t.co/4AnKD6begy pic.twitter.com/mADh74XEWn

— Congress Changes (@CongressChanges) February 19, 2021

Profile picture: Rep. Warren Davidson (R-OH) office account "WarrenDavidson"https://t.co/AG9rVPvdVJ => https://t.co/I8rlq7nKif pic.twitter.com/YslaXPAU9q

— Congress Changes (@CongressChanges) February 19, 2021

#NewProfilePic pic.twitter.com/JrMUkryZuk

— Nayib Bukele 🇸🇻 (@nayibbukele) June 6, 2021

I Meme and So Can You

The evolution of Bitcoin is quite similar to the evolution of language. Anyone can come up with their own new word and try to get other people to use it; most attempts at this will fail. Similarly, anyone can come up with a catchy new phrase or image and try to propagate it in order to reinforce one particular view of what Bitcoin is.

Definition of Bitcoin is like a definition of a word. It can morph and slowly change over time. No one controls it.

— Charlie Lee [LTC⚡] (@SatoshiLite) February 7, 2017

You don't have to be a programmer to contribute to Bitcoin. All you have to do is engage in conversation with your fellow Bitcoiners! Who knows, you might just stumble upon the next great meme that further solidifies consensus around some aspect of the system...