The Future of Bitcoin Mining

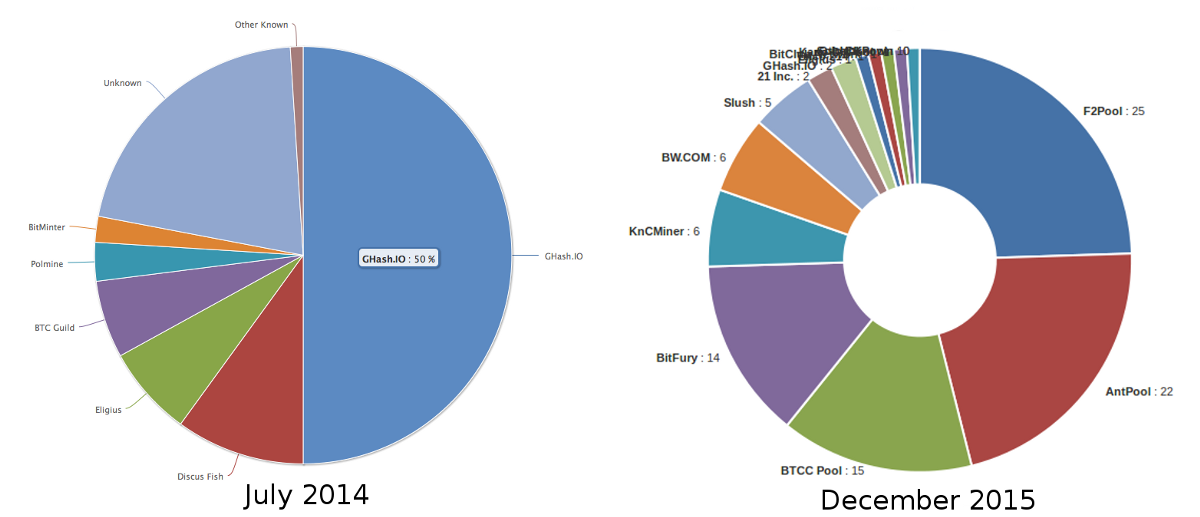

Bitcoin mining has evolved rapidly over the last 7 years, with three distinct generations of miners in terms of power efficiency:

- CPUs (2009–2010)

- GPUs & FPGAs (2010–2013)

- ASICs (2013-present)

At the time of writing, the third generation of miners have endured a race to the limits of silicon fabrication technology, with the first ASICs using 100+ nanometer technology while recent chips have been developed using more modern 16 nanometer technology.

As the value of a bitcoin has increased over the years, so has the mining competition, resulting in the need for significant up-front capital. Recent estimates have set the required startup capital for an industrial mining operation at $10,000,000. That’s over 1,000 block rewards (currently 25 BTC) and, of course, operational costs will eat into a miner’s revenue, necessitating an even greater number of blocks to be mined in order to achieve a positive return on investment.

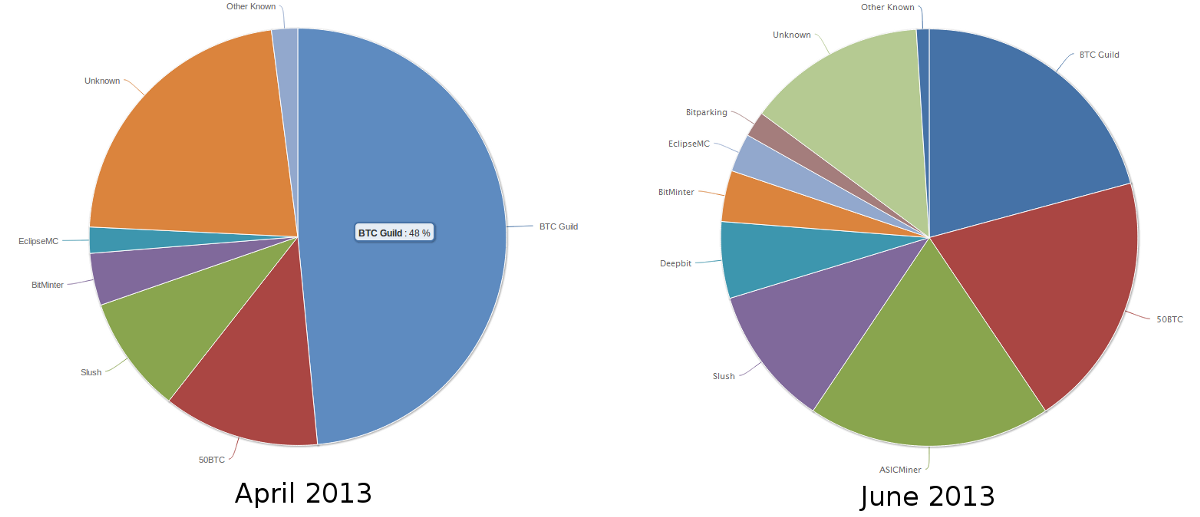

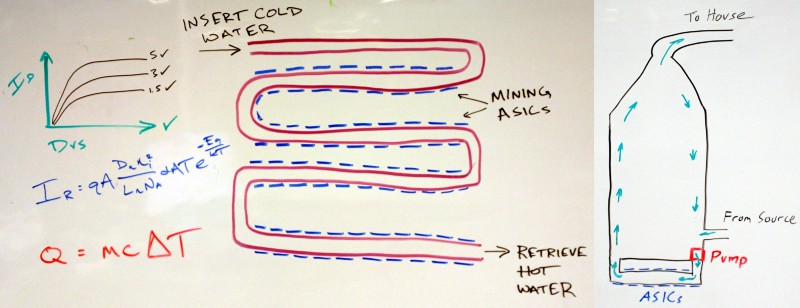

This leads to the question: where is the Bitcoin mining industry headed? Will mining continue to become even more centralized? Or will it swing back in the other direction? Over the years mining centralization has been swinging back and forth like a pendulum, at least as far as we can measure from looking at hashrate distribution across mining pools. It’s less clear how concentrated the pool participants are.

It seems that significant hardware advances cause centralization because fewer people are able to get their hands on the new generation of hardware, but as the advances become less significant the network decentralizes again because mining becomes more competitive. We can see the advances in hardware power from looking at the historic hashrate:

It’s unlikely that ASICs will ever again see the same velocity of improvements in performance and power efficiency that they enjoyed in the past two years. As a result, we will see industrial-scale miners compete on other factors such as power, cooling, and even new service offerings. I expect that industrial scale mining will continue to dominate the ecosystem for the next several block reward eras.

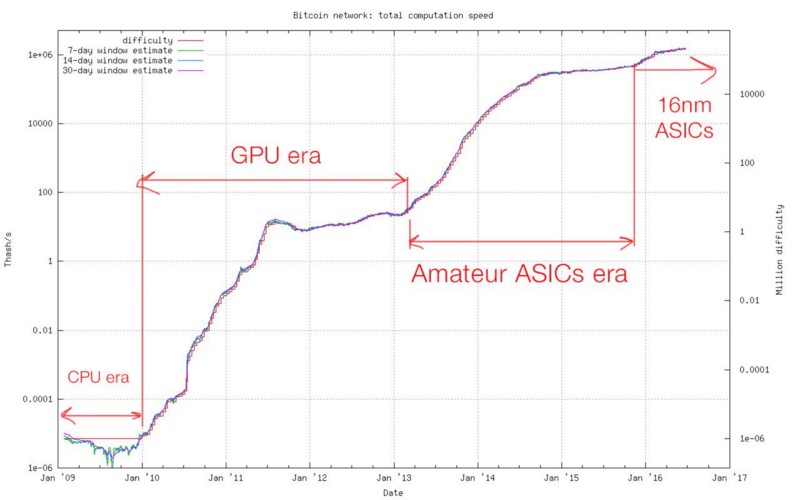

The greatest threat to industrial mining over the next decade will be the rise of embedded / integrated low powered mining. Full-time embedded mining is unlikely to be directly profitable in the same way that current industrial mining is profitable. It may take several forms — it could make economic sense if the miner was gaining additional utility from it, such as by heating a room or a water tank. We can only guess as to what such devices may look like, but it’s clear that if you can subsidize an existing necessary operation such as heating air or water by simultaneously earning satoshis, it’s a win.

Such devices may automatically turn on and off not due to mining profitability, but due to other factors such as ambient temperature. It could also make economic sense for a device to mine satoshis in order to make use of the Internet of Things and machine-payable APIs — the utility of gaining access to new economic networks could be worth mining at a slight loss. This seems to be 21’s vision and it aligns with their original claim:

Crucial to this is the idea that bitcoin generated by embedded mining is more convenient — and hence more valuable — than bitcoin bought at market price and manually moved over to the site of utility.

Don’t let the size of the 21 Bitcoin Computer deceive you - it is merely a prototype. Just as the initial Bitcoin ASICs started off using 100+ nanometer technology and dropped by an order of magnitude, the technology employed by 21 will also shrink. The proliferation of embedded mining will take hold once it transitions from the current proof of concept full-stack “Bitcoin Computer” to System on a Chip design. It is at this point that it will make economic sense to deploy embedded mining to the Internet of Things, with mining capability added to phones, routers, and perhaps even fridges.

The reason I find embedded mining to be such a powerful concept is that if it catches on we will be incentivizing the general public to mine at a net loss in fiat terms. If this sounds illogical, consider the perspective that the miner will essentially be paying for some other sort of utility, but they will be doing so by “spending” electricity. That is, you can sidestep setting up a billing relationship with a new service provider and instead just add a slight bump to your electricity bill - this reduction in friction can be valuable. If a sufficient number of devices are mining a sufficient portion of the global hashrate at a net loss, this could put for-profit industrial scale miners out of business. To be clear, “a sufficient number” is the big question — it would no doubt require a deployment along the scale of tens of millions of devices. But, if successful, embedded bitcoin mining may “buy” us re-decentralization of mining by subsidizing the cost of mining across the entire user base rather that concentrating it in industrial miners who must use economies of scale to remain competitive.

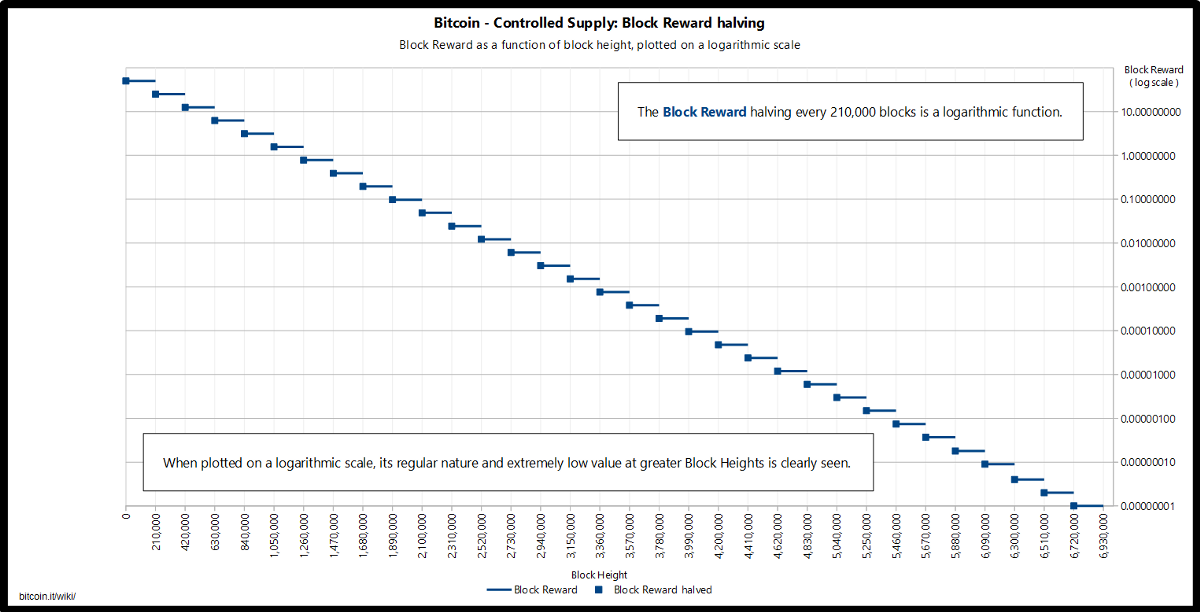

It’s no secret that the block reward will eventually drop to zero. Some time around the year 2044, we will enter the 10th block reward era and the miner subsidy will drop below 0.1 BTC. Unless a bitcoin is worth $100,000 in 2015 dollars ($250,000 in 2044 dollars assuming 3% annual inflation) then we’ll need plenty of transaction fees to continue paying for the same level of security. If Bitcoin survives to the point that transaction fees eclipse the subsidy of newly minted coins, the market dynamics will change for miners.

Delving into the psychology of large scale miners reveals that their definition of “rational” may not be the same as the average user’s. Many miners are treating their operation as a long term speculative play. From my conversations with miners, most do not immediately convert all of their earnings into fiat — they’ll convert what is necessary to pay for ongoing operating costs, but profits are likely to be saved in bitcoin. Because they care more about the long-term value of a bitcoin rather than short-term, it can result in miners performing “irrational” altruistic short term behavior, such as lending each other hashpower during emergencies, or reserving 50KB of space per block for no-fee transactions that spend “old coins.” This may also mean that miners likely care more about the total number of bitcoins they accrue rather than per-block profits in terms of fiat. If the exchange rate volatility drops to levels similar to major global currencies such as the dollar, pound, and yuan, or there aren’t large quantities of bitcoins being minted, they may take their holdings and fade away as a new generation of fee-hungry miners enters the market. These miners will be even scrappier and will compete for the slimmest of margins - they will also probably care more about short term profits rather than the long-term health of the system.

Eventually, miners will only collect transaction fees with no block subsidy, meaning that there may be a lot more variance in profitability from hour to hour. If the memory pool gets backed up then we can expect to see more users paying higher fees to incentivize miners to confirm their transactions. We are already seeing this in 2015 as events such a huge price swings cause a surge of people trying to enter exchanges in order to trade. This fee variance will result in a moving target for a mining profitability threshold. It’s feasible that if we see a wide distribution of embedded mining chips in a variety of devices that matches the vision being pursued by 21, they will automatically activate during periods of profitability when the threshold is crossed. If intermittent mining becomes popular and a significant portion of available hashing power is usually lying dormant, it could allow the Bitcoin network more “bursting” capability during periods of high demand. That is, if 50% of hashing power is usually offline and waiting for a mempool backlog with high fee transactions, bringing the dormant hashing power online would halve the time between blocks and thus double the network throughput.

If second layer off-chain payment networks like Lightning Network take off, they will also likely affect the dynamics of mining. As the block subsidy dries up, we could see large miners switch to running Lightning Network hubs, leveraging the capital they have built over the years in order to collect transaction fees on this new network with much lower operational costs. It’s also possible that cascading events on the Lightning Network occasionally result in hordes of users having to settle on-chain. This could occur if a large hub goes offline or if a node at the edge of the network receives a lot of value and has nowhere to push it, forcing users to drop out of the Lightning Network in order to make use of the stuck funds. This could conceivably happen if, for example, a Bitcoin exchange accepts Lightning Network payments and there is a huge swing in the exchange rate that causes people to “run for the exits” and convert their coins into other assets. Such events may trigger opportunistic intermittent miners to jump online and vy for collecting higher transaction fees.

I’ve only scratched the surface of the possibilities - there are a plethora of other variables that could drastically affect mining dynamics, such as:

- The price of electricity. Cheap renewable energy would be a game changer. Paying for access to networks / APIs with electricity becomes more appealing when electricity is practically free.

- The size of blocks and what level of fees are blockchain fees versus off-chain fees.

- The mining algorithm. If an algorithm is developed that everyone agrees is superior to Proof of Work then we could switch to it.

- Unforseeable flexcap-esque changes to the Bitcoin protocol that enable miners to “pay” for the ability to change block properties.

The only thing certain about the future of bitcoin mining is that it will not remain the same for long.