Satoshi Roundtable IX Recap

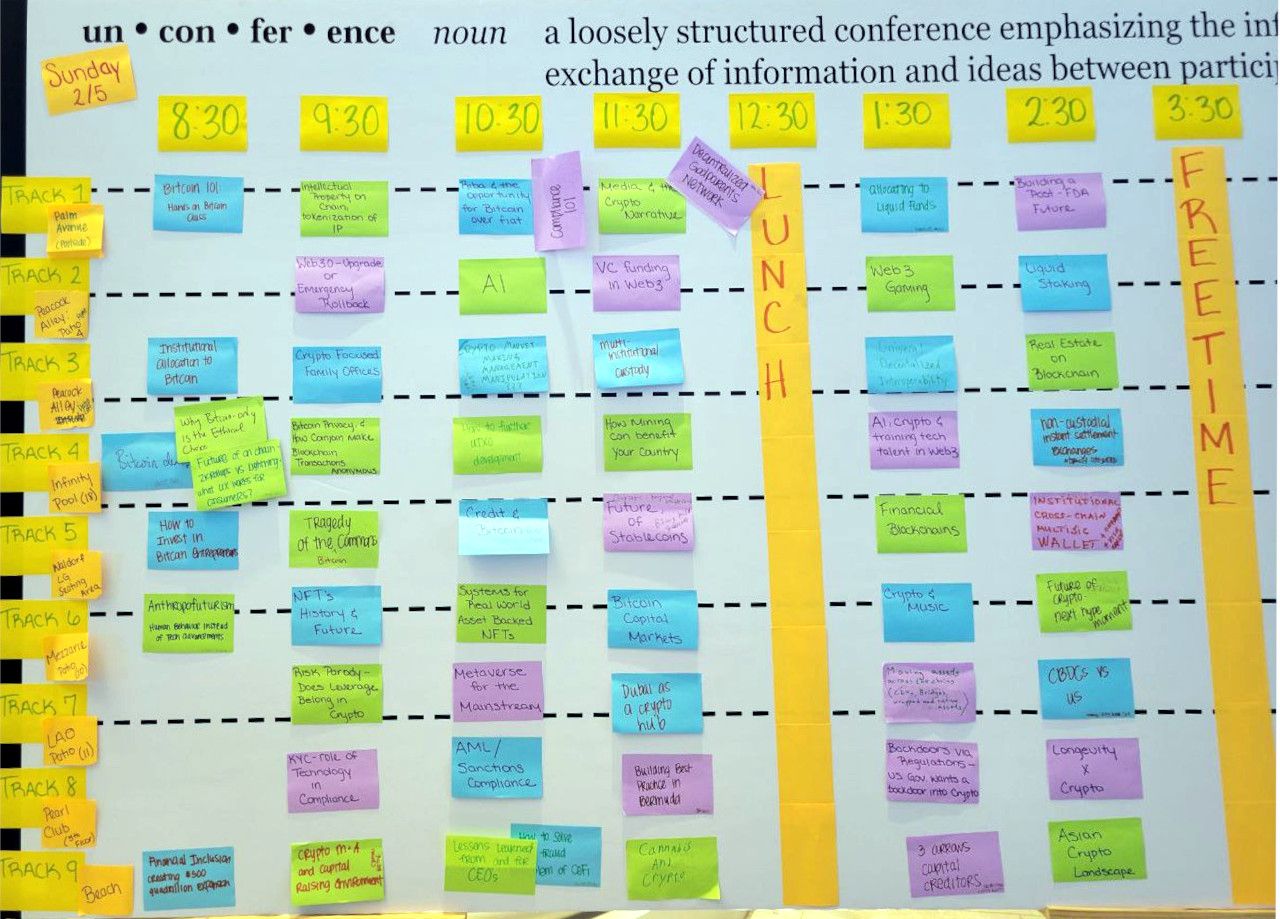

This was my 7th time attending this annual unconference and I chose to mostly attend sessions on topics in which I'm not an expert in order to maximize my learning opportunities.

We ran 9 tracks in parallel this year, so while I'm providing notes from 13 sessions, this is only a glimpse at 11% of the content that was covered!

The following are the insights I gained from the discussions in which I participated. This is a very long post; the topics are in the following order:

- Bitcoin Layers

- Bitcoin Ossification

- Funding the Bitcoin Commons

- Scaling Bitcoin with ZKSnarks

- Multi-Institutional Custody

- Hardware Attack Vectors

- DCG / Genesis / Grayscale

- Decentralizing Centralized Exchanges

- Islamic Finance / Muslim Markets

- Longevity

- Lessons in Self Regulations from the Nuclear Industry

- On-Chain Carbon Credits

- Universal Decentralized Interoperability

Bitcoin Layers

What constitutes a Bitcoin layer? This distinction can be a bit contentious in and of itself.

- Does a federated peg count? It's just a glorified multisig, right?

- Is an extension block a layer?

- One-way pegs are pretty easy

- Two-way pegs are trickier because you don't want the Bitcoin network to have to know anything about the state of other chains.

- A trustless two-way peg is a missing holy grail for sidechains

There are multiple types of data anchoring that can be facilitated with bitcoin. Some of them perform the anchoring for data integrity and verification, while others are for tokens.

The perspective of Bitcoin as a distributed database is still pretty rare to come across. I wrote about it back in 2016:

We should perhaps think of Bitcoin as a cryptographic accumulator. With enough layers anchoring into the Bitcoin blockchain, we create consistent demand for block space. These anchored layers can run with a relatively low security cost because they don't need to run a separate proof of work system.

Noteworthy legal precedent: TikTok successfully sued Baidu and won by using anchor data for Factom's blockchain. Meanwhile, Deloitte has stated that a document hash in the blockchain can be used as proof of existence.

So why don't we see more Bitcoin layers? There's simply not much tech or dev support for companies that want to anchor into Bitcoin. It's easier to bootstrap a new base layer than to create one that is anchored.

There is no single standard way of anchoring.

- HTLCs

- Zero Knowledge Rollups

- Cryptographic Proofs

- Merkle Trees

- Patricia Trees

Also, the garbage in, garbage out problem still exists - financial systems are full of bad data. Layers are about trusting cryptographic proof but the real world relies upon brand reputation. Big brand accounting firms that start to anchor into Bitcoin will help to transfer trust.

Economic incentives do not favor a layered bitcoin solution - it's easier to print your own money.

Additionally, the academic nature of bitcoin development is not as developer friendly as ETH foundation. For example, the ETH Foundation created tons of libraries, SDKs, and developer docs including code examples of use cases. This lowering developer friction and increased their ability to build monetizable apps.

There's no perfect path forward, but I believe that facilitating more experimentation on Bitcoin layers can only help the ecosystem. As such, it would be nice to see more protocol improvements that enable drivechains / sidechains with trustless 2-way pegs.

Bitcoin Ossification

The process for making consensus changes to the Bitcoin protocol is enigmatic because there is no formal process, nor does anyone have the authority to define a formal process. The Bitcoin Improvement Proposal process generally describes the recommended workflow at a high level, but the minutiae of how to accomplish the building and reaching of consensus is quite vague. "Rough consensus and running code" sometimes puts an emphasis on the "rough" aspect.

Who makes the decisions to move forward with proposed consensus changes?

- Technical consensus

- Miner consensus

- Node consensus

- Economic consensus

In order to make progress with a proposed change, someone must champion the idea. In recent years I've noticed a trend of developers who make improvement proposals and end their proposal by explicitly stating that they have no intention of proposing activation parameters. I believe this is because:

- More experienced devs are still weary / shell-shocked from the scaling wars

- Developers tend to be more introverted and desire to avoid politics

- Experienced devs have realized that championing your own idea is not as strong a look as having others champion it. Almost like co-sponsors of bills.

Apathy / inaction / veto is the default in Bitcoin governance. This is a feature; it means that to change the protocol you must convince others to take action, thus you must convince a large swath of participants that your change:

- Is valuable

- Is not harmful to others

What, if any, additional functionality is desirable for Bitcoin at the protocol level? Some say nothing - we can build any new functionality at other layers. This may be technically correct (at least, I can not disprove the claim) but it is clear that doing so would require far more work for certain things and could result in unnecessary complication. Take covenants, for example. It's technically possible to create forward-looking restrictions on bitcoin flows without changing the protocol, but architecting those flows is incredibly onerous, to the point that the cost seems to exceed the benefit.

As an other example, examine potential improvements like ANYPREVOUT that would enabled batching of Lightning Network channels. Without this scalability boost we have no way of allowing many users trustlessly share UTXOs for channels. As such, the only way Lightning can achieve mainstream levels of adoption will be for users to "share" UTXOs via a trusted third party custodian. Is that really the trade-off we want to make?

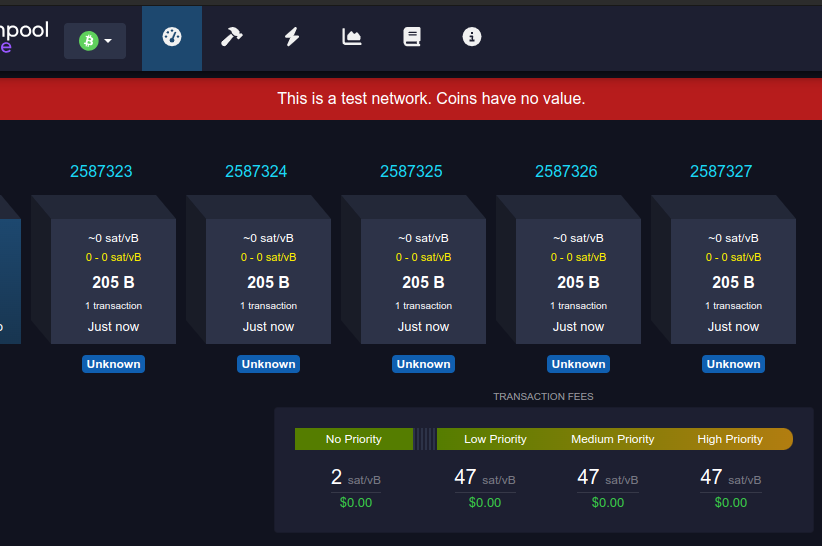

One objection I've heard several times is that we "shouldn't test features on mainnet" due to the value of the network and risks involved. This is an unreasonable objection, in my opinion, because there are a variety of ways to test and harden code. It's also unreasonable because it sets an impossibly high bar - there is no other network as valuable as Bitcoin upon which one can test new features. That is to say, while one can copy the protocol and code for testing, one can not copy the network / infrastructure / economics of Bitcoin. The next closest thing we have as an economically valuable test network is Litecoin, which arguably did help dispel certain economic FUD about Segregated Witness during the scaling debates.

Let us not forget the early thesis of how Bitcoin would evolve: it was expected that the vast majority of altcoins would fail to meaningfully innovate and thus they would provide us with real-world data of what not to do. But the experiments that proved successful were not a threat to Bitcoin, because Bitcoin could always choose to subsume said functionality and thus siphon off much of the value captured by said innovation. With sidechains, as envisioned in 2014, this was even more true, as the experiments would be taking place on bitcoin-pegged systems and thus the value accrued in a sidechain would automatically accrue in bitcoin. Well, that hasn't really happened. Why?

- Bitcoin doesn't have a marketing / developer advocacy budget.

- We don't have trustless two-way pegs.

- There's an incentive for folks to print their own money. Venture capital funded projects find themselves under immense pressure to do so in order to quickly provide liquid returns to the investors.

This flows quite well into the next topic of funding and incentives.

Funding the Bitcoin Commons

Bitcoin is the most valuable asset in the entire crypto ecosystem AND YET it is arguably the most underfunded in terms of protocol development. Our estimates are that about $10M per year is spent funding developers.

Even if the protocol is ossified (which is a whole other debate we've already covered) then it's still important to fund protocol developers. Most development is focused on testing, debugging, performance improvements, and maintaining compatibility. Perhaps we should be pitching the necessity of this funding as "Bitcoin maintenance" rather than as "Bitcoin development."

How do we fund more development? Potential funding ideas:

- A Nobel Prize for Bitcoin contributors who have gone above and beyond.

- A Giving Pledge for large / highly profitable companies in the space

- Create an endowment that HODLs for many years before starting to spend funds

- A "Round Up" sats donation program that could be implemented by bitcoin checkout systems

The protocol incentives aren't great in Bitcoin; the miners accrue all of the value as a result of people using the protocol. Implementing a "dev tax" would be too controversial - we already saw how that experiment plays out via eCash (currently valued at 25% of the BCH network from which it forked when it added a dev tax.)

Due to the volatile cyclical nature of the bitcoin market, donation models result in unpredictable funding streams. How can we smooth this out? Perhaps by getting more distributed revenue streams?

Unfortunately, funding individual devs in a more peer to peer fashion via github / patreon is onerous. I've done this myself and it takes effort to regularly re-assess who you're funding.

Grant-based programs, which are the standard for funding these days, aren't great for devs. Few folks want to work on one year contracts and prefer to have the stability of full-time employment. It's also tough because these grants tend to pay well under the going rate for working in a similar position at a for-profit company.

Scaling Bitcoin with ZKSnarks

Zero knowledge proofs and roll-ups allow you to perform many operations off-chain and then condense them into a small proof. With ZKSnarks, Bitcoin could scale via an accumulator-validator architecture. However, this would require fracturing transactions by type / UTXO via sending them to a specific validator to be processed in batches with some delay.

Currently, the best rollups (implemented on Ethereum) take over a minute to create the proof and have obscene RAM requirements. The resulting validity proof provides evidence that all the rules of the protocol have been followed, thus allowing you to then throw away the historical data of all the transactions that happened. But this does require for you to trust the math behind the proof. ZKPs make the most sense when you have historical data that you don't need to query because you only really care about the current state of ownership.

A problem with current implementations of optimistic rollups is that you are trusting a small number of validators (due to the resource requirements.) Starkware, Polygon, Optimism, etc. If you want to learn more about how rollups could be applied to scaling Bitcoin, check out John Light's research that's published at https://bitcoinrollups.org/

Another way of scaling Bitcoin with zero knowledge proofs is via ZeroSync. ZeroSync allows to verify Bitcoin's chain state in an instant without needing to download hundreds of gigabytes of blocks. A compact cryptographic proof suffices to validate the entire history of transactions and everyone's current balances. If, of course, you trust the math behind the STARK proof...

Multi-Institutional Custody

It's quite clear that custodians are single points of failure, yet this industry continues to repeat the same mistakes for the past decade. Many folks are afraid to take on the risk and responsibility required to self custody. They would love to be able to insure their bitcoin, but this is not really an option due to the nature of bitcoin and inability to recover from catastrophe.

Custody is no longer a binary attribute of self custody vs third party custody. With keys distributed across multiple parties, it can become a hybrid model where no one has full control. This will, of course, raise some interesting legal issues. With the addition of miniscript we can also craft more complex key management policies. No longer do all keys in a multisig need to be weighted equally. From an insurance perspective, policies become much more tenable if your insurance provider becomes a required signer for the wallet.

The lack of affordable insurance is arguably hindering institutional adoption of bitcoin. Most insurance policies today are "specie insurance" that only cover the physical theft of HSMs. We need policies that will cover any crime that results in loss of funds. Pretty much all custodians who market themselves as being insured actually only have policies that cover a tiny fraction of their assets under management, and often do NOT cover a variety of crimes such as internal attacks / rug pulls by employees at the company. For example, FTX had a $7M crime policy but it did not cover actions committed by board members...

The Basel Accords and Bank of International Settlements require that banks that hold crypto assets keep them collateralized 1 to 1 with a matching amount of fiat. Naturally, this is untenable given volatility and the fact that this capital is unproductive - it greatly eats into a bank's profitability. But if the bank wasn't a custodian, they can avoid those requirements.

One downside is that insurance contracts must be signed by known identities in order to be legally enforceable. Thus this setup may be more amenable to institutional custodians than to individuals who value their privacy.

If you want to learn more about the advances being made in this area of multi-institution insured custody, check out what AnchorWatch is doing.

Hardware Attack Vectors

Before 2010 we didn't see many attacks that exploited CPUs, but as the complexity of their architecture increased, we started to see attacks such as Spectre and Meltdown. These vulnerabilities can essentially give an attacker "god mode" access to see everything that is happening on a compromised machine.

In 2018 there were strong allegations made of a supply chain attack at a Chinese hardware manufacturer that affected dozens of American tech giants. If true, it's evidence that nation state attacks against advanced hardware can go undetected for many years.

The Bitcoin mining industry has experienced several issues with compromised hardware.

- Antbleed was a backdoor inserted by Bitmain into their firmware.

- ASICBoost was an optimization Bitmain built into their chips but did not enable for users who bought the hardware. It's suspected that Bitmain only enabled it on the machines they used to mine for themselves.

- We also hear rumors of some hardware siphoning undetectably small amounts of hashrate (within the margin of error for measuring hashrate) to enrich the manufacturers, but I don't believe this has been reported upon.

Pretty much all hardware these days (both Bitcoin and otherwise) is unverifiable. The one exception is the RISC-V open architecture, which has little adoption. What little open source chip architecture that is available tends to be obsolete and incredibly poor performance compared to more complex modern chips. This is scary from a security standpoint because it means we're blindly trusting devices that provide fundamental utility for many aspects of our lives. This is one of the reasons why Casa's multisig security model involves storing keys on a variety of devices from different vendors - so that users need not trust any vendor or supply chain.

Of course, verifiable hardware is not a panacea - security is a complex multivariate problem, and even if the entire world ran on open source hardware, we'd still have security flaws in other places such as networking, software, and the humans who operate them.

DCG / Genesis / Grayscale

Of all the crypto failures in the past year, this one hurts the most. These folks were thought to be "the adults in the room." Yet it seems Genesis & Grayscale are a commonality among many of the other bankruptcies recently. Organizations like 3 Arrows Capital and BlockFi took client funds and poured them into "the Grayscale trade," betting that the premium of GBTC over NAV wouldn't crash. They were wrong. An open question is just how complicit the DCG entities were in pushing organizations to engage in these practices; there are rumors of bribes / kickbacks being made to hedge funds...

A particularly upsetting fact is that tons of investors have their retirement funds in GBTC and have been expecting an ETF for years. An ETF would cause the discrepancy between GBTC and BTC to evaporate and it would also vastly lower Grayscale's management fees. The management fees for GBTC are egregious; trusts tend to charge under 1% of assets under management annually. What's even more egregious with GBTC is that Grayscale charges 2% of NAV (BTC) rather than 2% of GBTC. As such, with GBTC running at near 50% discount to NAV, that means that Grayscale's fee is actually closer to 4% of the total Trust value.

One crazy point is that many folks are sitting on unrealized losses in GBTC even though BTC is trading at a higher exchange rate than when they originally invested.

There are potential securities violations with regard to how DCG gave 10% of their shares to Gemini as collateral for their Earn program relationship. Gemini liquidated half of that and apparently DCG hasn't forked over the remaining half.

How might this all play out for Grayscale?

- There's currently an activist movement to try to force redemptions. It seems unlikely to succeed to me, given that the terms of the Trust have changed 4 times to make it harder for activist shareholders to succeed in forcing changes.

- Doing in-kind redemptions with retirement funds are more complicated if not impossible, and may need a different structure in order to pull off redemptions without causing a massive sell-off.

- Grayscale could file for Reg-M relief at any time to kickstart the process toward redemptions. But they're not incentivized to do so, as it would kill their golden goose.

- The Trust could be moved to a foreign market in order to convert it to an ETF

- The Trust could also change sponsors to one that would allow redemptions

- There are 2 parties with "God power" over the trust who could force liquidation / redemptions: the SEC and the Attorney General of Delaware

- Rumor has it that there are currently open bids for the acquisition of Grayscale

In-kind redemptions could cause a lot of trouble with regard to custody - many participants simply can't custody BTC due to regulatory restrictions. However, if anyone can redeem in-kind, it ought to create an arbitrage opportunity that would close the gap between GBTC and BTC.

Finally, a particularly nasty aspect to all of this that the activist movement has to be wary of is that the Trust has an "extraordinary expense" clause that allows it to liquidate BTC in order to pay for expenses that are "for the good of shareholders." Point being, any action that threatens the status of the Trust could conceivably be argued to be detrimental to shareholders, and their own money could be used against them to fight legal battles!

Decentralizing Exchanges

How does one transform a CeFi exchange into DeFi? The best example may be Shapeshift, though they were already well on their way to DeFi from the get-go.

Clearly the biggest chokepoint is the on-ramps and off-ramps with the TradFi system. Banks want to see licenses, a physical headquarters, an established Board with identified members, and so on. A DAO or software will have none of those attributes. How do you remove dependency on the TradFi rails? In theory you can facilitate peer to peer exchange, but this introduces another gnarly problem: dispute resolution.

An elephant in the room with many DEXs is that they actually run on centralized infrastructure. While there may be a decentralized smart contract on a blockchain, much of the user interface runs on traditional servers. So for a DEX to be truly decentralized, it needs to have fully functional client-side applications that aren't reliant upon third party servers.

Another slight issue with DEXs is that they can't actually run order books. They tend to operate with AMM liquidity pools, which can lead to weaknesses such as MEV (Miner Extractable Value) and Impermanent Loss (if pool liquidity disappears.)

An intermediate solution that doesn't require pure DEXs would be to break up the roles of trading and custody, which is how much of the traditional asset world operates. But this feels like a step backward, and it introduces even MORE intermediaries. Done right, it could reduce risk, but more intermediaries means higher fees because folks won't be providing their services for free.

Fun fact: DeFi trading volumes are already at 10% that of CeFi volumes, despite their clunkiness. The biggest hurdle for DeFi adoption may be self custody, as most people are only used to managing email / password login credentials as opposed to private keys.

Let's say you manage to decentralize an exchange to the point that it's a DAO - there are plenty of operational issues to address at that point. For one, DAO governance is poorly understood in comparison to corporate governance - you're creating custom game theory and there are plenty of opportunities to screw up the incentives. Lastly, DAOs may find themselves challenged in the long term due to being less responsive to threats from more nimble corporate competitors.

Islamic Finance / Muslim Markets

“Riba” is a complicated Arabic term loosely defined as interest. It can often be hard to pin down as it can change depending on the situation. In general, it's considered immoral to make money by doing nothing other than lending money. When I asked if the reasoning behind this morality could be better explained, I was pleasantly surprised by the answer.

When Islam came to be, the world existed on a sound money gold standard. Because the money was not being debased, if you lent a gold coin to a neighbor then it would be greedy to expect more than a gold coin back, because the value being returned ought to be higher than when it was lent. A similar view on "usury" exists in Christianity, though Christians don't seem to place much weight on enforcing it. But alas, eventually fiat systems came along and the religious views were not updated to match reality, thus folks had to get creative in order to be compliant with both the old and new world systems.

In practice, there are a variety of ways to architect financial assets and services so that any yield generated come from some activity other than simply servicing a debt.

A sukuk is a sharia-compliant bond-like instrument that involves a direct asset ownership interest, while bonds are indirect interest-bearing debt obligations. Both sukuk and bonds provide investors with payment streams, however income derived from a sukuk cannot be speculative which would make it no longer halal.

Mortgages have to be structured differently for several reasons. There is also a risk sharing component to Islamic Finance; in order for deals to be considered fair, both sides should assume an equal amount of risk. Instead of a western style mortgage in which the bank gives you a loan for you to buy a house, in Islamic Finance the bank buys the hose and then enters into a fixed payment plan more like a lease. Though I'm told that the banks often break one of the rules when engaging in the house purchase transaction because they don't actually buy the house until after the client signs the mortgage paperwork. This means that the bank is selling a house that it doesn't actually own, which is considered fraud.

It's also possible to effectively securitize yield-bearing financial products in order to create value flows that are not considered to be riba. You can take an asset, place it in a Single Purpose Vehicle that is insolvent remote, and sell bonds for it. The bond holders are effectively buying the assets held in the SPV, which generates yields on the assets that are held in a separate trust. Thus the SPV's purpose is to pay the bond holders with the yield generated by the assets in the trust. Sounds kind of convoluted, but whatever makes folks happy...

In this past cycle we saw the securitization of industrial scale miner revenues, but the SEC is not fond of folks lending actual assets. Now we're seeing middlemen pop up who are acting as brokers for Layer 2 tokens due to the time restrictions and friction involved in pegging assets back and forth between layered protocols. From a financial perspective, these middlemen have cash flows that are generated as a result of the capital / assets they are holding, but they are NOT engaging in lending. As such, these activities are likely shariah compliant.

The essence of securitization is that you are creating an asset that pays out, NOT in-kind (more of the same asset) based upon capturing some kind of value flow. One particularly unique asset that acts like this is actually Stacks, which allows you to stake STX but receive payouts in BTC. Thus it could also be shariah compliant.

One final example of a shariah compliant pure crypto yield generating activity would be running a routing node on the Lightning Network. Similar to the Layer 2 token brokers, a Lightning node operator is not lending assets but rather has capital allocated and takes fees based upon flows of value within their own capital.

Another interesting tidbit on Islamic economics:

- No income tax

- No property tax

- No sales tax

- No capital gains tax

- Only a 2.5% tax on "excess wealth," which does not include real estate

Islam is decentralized - there is no single authority who can state that Bitcoin is Sharia compliant. Rather, such a proclamation must be made by scholars in each jurisdiction. Each Islamic country has its own regulator who handles matters of Sharia compliance.

If you want to learn more or ever need to make a case for why Bitcoin should be considered Shariah compliant, check out this 50 page research report.

Longevity

There's an overlap between longevity and cryptography enthusiasts that dates back to the 1980s with the Extropians. You may recall that Hal Finney himself was interested in these concepts and was an early adopter of cryogenics.

Due to the expected acceleration in medical technology and thus the incoming boost to life expectancy, potentially even to the point that we can add more than a year of life expectancy per chronological year of time that passes, the next couple of decades could be the worst time to die! It would be terrible to fall short of being able to make use of longevity breakthroughs.

With longevity there are 2 primary goals:

- Healthspan: your length of high quality life. (~70 years)

- Lifespan: your total life. (~80 years)

An important quantitative attribute for longevity enthusiasts is your biological age, which is different from your chronological age. It can be measured in several ways.

- Only 20% of your biological age is based upon your genetics

- Diet, exercise, lifestyle, and sleep are major factors

There are 9 hallmarks of aging - biological processes that result in our bodies breaking down and eventually ceasing to live.

Primary hallmarks (causes of damage)

Antagonistic hallmarks (responses to damage)

Integrative hallmarks (culprits of the phenotype)

- Stem cell exhaustion

- Altered intercellular communication

One interesting philosophical belief within the longevity movement is that it's not so much that we should strive for immortality, but that we should have the freedom to choose when we die.

Aging is a multivariate problem, so we should not expect that it will be solved overnight with any one specific remedy. However, there is consensus that the most important factor by far is your quality of sleep.

- 80%+ of humans need 7 to 9 hours of sleep per night.

- Even a few hours of sleep deprivation harms your immune system and it can take weeks to recover.

- You should preferably allow yourself to wake up naturally rather than via an alarm.

- You should not eat for at least 3 hours before going to sleep.

- It's better to sleep in a colder room.

Another common misconception is that red wine is healthy. There's no such thing as healthy alcohol - it's all poison. However, what many studies fail to account for is the socialization aspect of drinking alcohol. Having close, intergenerational, social structures have been shown to increase life expectancy. Overwhelming loneliness can even shave 7 years off of your life expectancy - humans are social creatures, even those of us who are introverts!

On a similar note, spirituality can provide your life with meaning and improve your mental health. Even if you are not religious, finding a connection to the universe and feeling like you have a place can reduce stress and thus improve life expectancy. Psychedelics can certainly aid in finding your spirituality / connection to the universe.

On the exercise side: high intensity interval training 3 to 4 times a week is a great stressor on your body to facilitate physical health.

With regard to medical care: get checkups and bloodwork done at least annually. The two greatest health concerns for the average person are cancer and cardiovascular disease - both of which can be treated better when caught early.

Finally, on the issue of mitochondrial health:

- Avoid highly processed foods; they tend to contain rancid oils

- Avoid toxins and heavy metals

- Regularly expose yourself to saunas and cold plunges / cryotherapy

- Engage in intermittent fasting to promote autophagy, which cleans out your degraded cells.

Further reading:

Lessons in Self Regulation from the Nuclear Industry

The nuclear energy industry is highly regulated, but most folks don't understand that it's actually mostly self regulated. The nation state regulators rarely intervene because other industry agencies are more responsive.

If we look at the history of nuclear energy, it's one of catastrophic accidents that quickly result in new best practices being implemented. For example, after Fukushima it became standard practices to have diesel backup generators installed at an elevated location... even if the plant was not in a flood prone area.

When we survey the history of crypto regulation, we also see a litany of catastrophes. And yet we are not seeing the industry regulate itself any better. After each major custodian failure we often talk about proof of reserve for a month or two, then everybody forgets and moves on to other issues. The may be an issue of incentivization.

If we look at the history of financial regulation, we also don't see much self regulation. The regulations have to be handed down and enforced by authorities. Perhaps because the harm is not existential / life & death? Financial system failures can affect far more than just the folks who were speculating on the latest financial products.

Financial games are far different: there is a much larger group of more diverse players, so it's difficult to coordinate social pressure or shunning. And in the case of traders, they are incentivized to seek out liquidity even if there is counterparty risk. Finance is ultimately a bunch of risky games you play while trying to limit your risk. But if you don't play, the potential rewards are limited.

From some traders I talked to, there is an issue of socially acceptable risk. By which I mean: many major fund operators knew that FTX was a suspicious operation, even though they may not have believed it was to the level of outright fraud. It was considered risky to use them, but there were very few derivatives markets to choose from. If many or most of the market makers had agreed that FTX was unacceptably shady, then those who went against the conventional wisdom and traded their anyway would find themselves exposed to additional legal risk in terms of lawsuits from limited partners when FTX collapsed. But since "everybody was doing it" there's a bit less liability because it's harder to claim that using FTX was outright negligent.

So, how might we improve self regulation of the crypto industry? I believe it would require a voluntary consortium of the players with the most skin in the game. Market makers, investment funds, miners, really any entities that have massive exposure to these custodians and have the most to lose. They have the collective bargaining power to demand that custodians subject themselves to financial and security audits. Obviously I'm biased due to my involvement, but I'd suggest that Cryptocurrency Security Standard audits be adopted as a minimum bar for custodians to meet.

On-Chain Carbon Credits

Carbon credit markets are highly fractured; coming up with global standards for how to create, trade, and destroy carbon credits can improve the trustworthiness of these markets and reduce friction for using them. The value of carbon credits is actually supposed to decrease over time, which poses an additional accounting challenge. Also, due to the fractured nature of the markets there is a huge problem with "double spending" of credits.

There are many different carbon markets, registries, and verifiers. They're often operated at a national level. But international REDD+ credits in particular are known to facilitate high levels of fraud. REDD+ is a United Nations-backed framework that aims to curb climate change by stopping the destruction of forests. REDD stands for "Reducing Emissions from Deforestation and forest Degradation."

Oddly enough, the largest buyers of carbon credits tend to be the largest issues of carbon credits, such as major petroleum companies.

The SEC requires companies that claim carbon neutrality to explain how they are doing the accounting of their offsets. More and more companies such as travel services are selling offsets as an add-on to your ticket.

Another thing that's on the horizon is the tokenization of nature based assets. Though a potential dystopian future is that a lot of natural resources such as those in international waters end up being sold off and harvested, causing massive ecological harm.

Of course, it isn't as simple as "blockchain fixes this" - a blockchain is just a database, and databases suffer from the "garbage in, garbage out" problem. So on-chain carbon credit systems must be paired with a more robust system of verifiers, preferably a p2p system.

Despite the promise for blockchain based markets to fix fractured regional markets with globalization, yet another problem is that there are already multiple blockchain based markets. Thus this market issue won't actually be solved until we see cross-chain interoperability between the different markets.

Universal Decentralized Interoperability

Just as there are a wide variety of markets scattered across the world, so there are many different blockchain based protocols. However, while traditional markets have developed ways of "talking" to each other and facilitating trade, decentralized protocols have not done so well.

The most common form of blockchain interoperability we see today are "bridges." But bridges tend to be attack vectors.

- Centralized exchanges act as bridges, but are trusted and can fail in many ways.

- Trustless bridges still expose users to smart contract risk; there have been plenty of high value hacks of "trustless" bridges.

Bridges also have poor scaling properties. If you think about it, in order to facilitate direct trade between N chains / protocols, you have to support N * (N - 1) possible combinations of swaps. Thus every time a new asset is created, you have to add N - 1 new pairs. This is a geometrically increasing complexity.

How do traditional markets interoperate? They abstract ownership of assets by creating holding companies so that the exchanges themselves don't have to support moving ownership of assets back and forth. What if we could create a similar abstraction for decentralized protocols? The process would basically be:

- Lock the native asset on its chain

- Use a name service to create an entry on an abstraction layer

Open questions are:

- Can this be done without oracles?

- Who runs the abstraction layer infrastructure?

- Can this be done without affecting the fungibility of abstracted assets?

- What are the privacy and scalability attributes of the abstraction layer?

There are the things Wire Network is working on addressing with their Universal Polymorphic Address Protocol; if you want to learn more you can read their documentation here.

Conclusion

As the crypto ecosystem continues to grow, the diversity of attendees at this unconference does as well. It's overwhelming trying to keep up with all of the developments in this space, so I greatly appreciate being able to receive so many crash courses over the period of a few days.