How the SEC Nearly Destroyed my Retirement Account

As the Bitcoin mantra goes: "not your keys, not your coins." I've seen several folks push back against this line of thinking by making the comparison to ownership of other assets. One particularly incredulous person recently posted something along the lines of:

"This perspective of ownership is ridiculous; almost no one takes possession of stock certificates from their brokerage. Are you claiming that no one owns stock?"

Yes, this is exactly what I'm claiming. While you may have a legal claim to an asset that is controlled by a third party, if you don't actually control it then there are innumerable events that could result in your ownership claim being rendered moot.

Story Time!

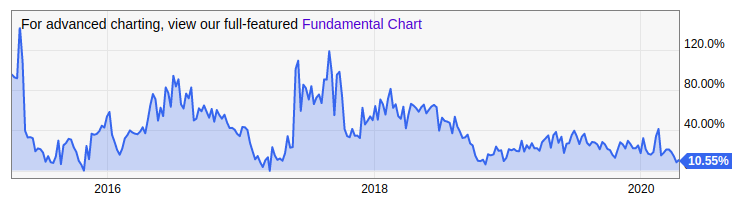

I've held GBTC in my 401K for a number of years so that I could get exposure to bitcoin in my tax advantaged retirement account. However, GBTC has issues with large premiums as high as 100% since buying a share of GBTC does not result in the underlying Grayscale Bitcoin Investment Trust acquiring more bitcoin.

So in 2018 when I heard about a new bitcoin ETN that was designed to closely track the price of BTC, I sold my GBTC shares and bought Bitcoin Tracker One - trading symbol CXBTF. Unfortunately, the honeymoon was short-lived.

On September 9, 2018 the SEC put a trading halt on CXBTF, stating that:

there is a lack of current, consistent and accurate information concerning Bitcoin Tracker One, issued by XBT Provider AB, a Swedish company headquartered in Stockholm, resulting in confusion amongst market participants regarding these financial instruments. For example, the broker-dealer application materials submitted to enable the offer and sale of these financial products in the United States, as well as certain trading websites, characterize them as “Exchange Traded Funds.” Other public sources characterize the instruments as “Exchange Traded Notes.” By contrast, the issuer characterizes them in its offering materials as “non-equity linked certificates.”

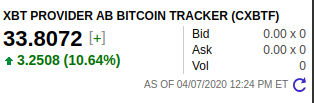

I didn't find this particularly concerning because the SEC only suspended trading for 10 days, though September 20, 2018. I went on with my life and a few months later I checked in on the trading action; to my surprise my broker was showing no bids, no asks, and no trading volume!

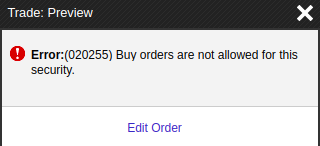

As a test I tried to execute an order, only to find that my brokers stopped allowing orders to be placed!

I called up my broker and asked what was going on. The support agent said that they had no idea when trading would be allowed again and that I should just wait a while and check back later.

Did I get Goxxed by the SEC?

It was starting to feel like Groundhog Day. I called up my broker and asked when I'd be able to access my assets. The support agent said that they had no idea when trading would be allowed again and that I should check back later. I decide to start digging deeper into what was going on.

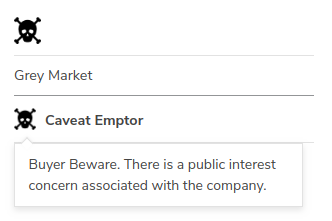

I knew from my broker that CXBTF was listed on the OTCQX market, so I headed over to the OTC Markets site to see what they had to say about it. I was immediately greeted with:

Warning! Grey Market securities are not traded on the OTCQX markets

Broker dealers are not willing or able to publicly quote these securities because of lack of investor interest, company information availability or regulatory compliance.

The OTC Market page listed a slew of potential reasons why this could be the case, including trading suspension, but didn't give the specific reason of why it was still a Grey Market security despite the trading halt having expired.

OTC Markets will resume the display of this security’s quotes once adequate current information is made available by the issuer pursuant to the Alternative Reporting Standard or by the SEC Reporting Standard, and until OTC Markets believes there is no longer a public interest concern.

I emailed the OTC Markets trading services to ask what was required to get the caveat emptor status removed. They replied:

Anytime a security is suspended by the SEC we assigned the caveat emptor (CE) designation. The CE will only be removed if a form 15c211 is filed by a market maker with FINRA to quote this security.

At this point I emailed CoinShares, the company that operates the ETN, asking if they had any idea when this status would change and the OTC Markets would reopen.

Due to US Securities Laws, XBT securities are not available for purchase in the United States (indeed, we are generally unable to communicate with US investors.) We apologise for the inconvenience. We can only advise you to speak to your broker directly. Someone there will be able to help you.

I grew weary of getting the runaround and was in no rush to sell, so I took a break.

Funds Are SAFU?

Now it was summer of 2019 and the bitcoin price had tripled since bottoming out around $3,000. I figured it was a good time to make sure my retirement assets were worth what my brokerage account was stating and not actually $0 because they couldn't be liquidated.

I called my broker and asked to speak to the trading desk.

Me: <explains predicament all over again>

Trading Desk: "We can place an order for you but due to the incredibly low volume it might not execute or could take weeks to fill. Every day the order gets executed it will charge you new trading fees."

Me: "This is ridiculous; I can see that Bitcoin Tracker One is trading in high volumes on the Swedish stock market. Why can't I just sell my shares there?"

Trading Desk: "Well sure, you can do that via our International Trading Desk."

Me: "OMGWTFBBQ! Why did no one mention this option over the past 9 months!"

Next I found myself talking to an employee at the international trading desk.

Me: <explains predicament all over again>

Trading Desk: "We can place a sell order but are prohibited from placing buy orders. How would you like to proceed?"

Me: "I'm not in a rush, I just want to safely liquidate all my shares at the market rate."

Trading Desk: "OK, please confirm that you want to place a limit order for ____ shares of CXBTF with an asking price of 150 SEK."

Me: "Uh, Swedish Krona? I only know the price in US Dollars. Hold on." <looks up exchange rate> "NO! NOOOOOOOO! The fair market value is 450 SEK! WTF?"

Trading Desk: "What? My trading terminal shows the last tick at 150 SEK..." <types frantically> "Whoops, it's reporting the price from September 2018 when trading was suspended. Good thing you caught that!"

Me: "No shit."

Trading Desk: "OK, please confirm that you want to place a limit order for ____ shares of CXBTF with an asking price of 450 SEK."

Me: "Fine. Confirmed."

After this close call was narrowly averted, I held my breath for the next couple of days but thankfully the trade was executed smoothly and the funds shows up in my account.

A Learning Experience

I had known all along that my broker was a trusted third party; what I didn't realize before this saga was how many points of failure existed in the system.

- The brokerage controls the stock certificates.

- The transfer agents are also a point of control for stock certificates.

- The markets control the price information.

- The regulatory agencies control the markets.

We're still in the extremely early days of censorship resistant peer to peer decentralized markets. I, for one, look forward to a future where we can engage freely in trade directly without multiple layers of intermediaries who can wreak havoc on our finances at the slightest whim.