Bitcoin 2023 Annual Review

I’ve always been fascinated with the raw numbers relating to the operational status and growth of Bitcoin, especially as we ride the rollercoaster of the adoption life cycle. This interest spurred me to create Statoshi.info in 2014 to track bitcoin metrics from the perspective of a full node.

To that same end, I’ve compiled statistical measurements of Bitcoin’s growth in 2023 from a variety of sources. It can be difficult to see all of the moving pieces since the data is so distributed, but the picture becomes clearer when you bring them all together.

The one theme that I've taken away from all of these metrics is that 2023 was the typical sideways action we tend to see as the bear market ends and the bull begins; we have once again persevered through some significant setbacks.

Bitcoin is at the forefront of an increasingly complex ecosystem that continues to grow in a variety of ways. And for the 15th straight year, it stubbornly refused to die!

Bitcoin Obituaries pic.twitter.com/Tyt2DNTRw2

— Jameson Lopp (@lopp) December 20, 2023

General Interest

The new entrant this year for relative search interest is... Brazil! Apparently this is because their government is really screwing over the citizens and they're seeking safety.

Countries with highest relative search interest for Bitcoin were mostly unchanged in 2023. Brazil is the newcomer while El Salvador remains Bitcoin country. pic.twitter.com/ZrBQ2efKl7

— Jameson Lopp (@lopp) December 21, 2023

General interest in educational resources remained low. This makes sense, as we tend not to see many new entrants until the FOMO phase of peak bull market hits.

Visitors to my educational Bitcoin resources were down another 30% year over year to 76,000. pic.twitter.com/l4zWKAfsr5

— Jameson Lopp (@lopp) December 20, 2023

X chatter was fairly flat. Considering all the upheaval by Elon, it's impressive that volume was only down 9%! My own account's total impressions were down 30% year over year.

95 million posts containing the word "bitcoin" were published on X in 2023, down 9% year over year.

— Jameson Lopp (@lopp) December 22, 2023

H/T @wullon pic.twitter.com/xaJ63FZasJ

The bitcoin subreddit saw steady growth, with one likely spambot spike.

/r/bitcoin added another 1.2 million subscribers in 2023, though it looks like half of them are likely fake. It's the 91st most subscribed subreddit. pic.twitter.com/xPKIzGrYmI

— Jameson Lopp (@lopp) December 20, 2023

I myself abandoned BitcoinTalk many years ago because I felt it was hard to find signal through the noise. It looks like user growth on that site decelerated even more in 2023.

BitcoinTalk total registered users: pic.twitter.com/zLiWeenNMV

— Jameson Lopp (@lopp) December 20, 2023

Academic Interest

Academic interest continued to increase, which is great for the long-term prospects of this industry as we continue to gain a greater understanding of what we’re building.

Google Scholar Articles Mentioning Bitcoin

— Jameson Lopp (@lopp) December 21, 2023

(note: 2023 number will ⬆️ due to listing lag) pic.twitter.com/9WXL27IW1S

Though it seems the hardcore cryptographers have moved on to other things?

Cryptology ePrint Archive Papers Mentioning Bitcoin pic.twitter.com/4d0ZrqRjao

— Jameson Lopp (@lopp) December 21, 2023

Funding and Forking

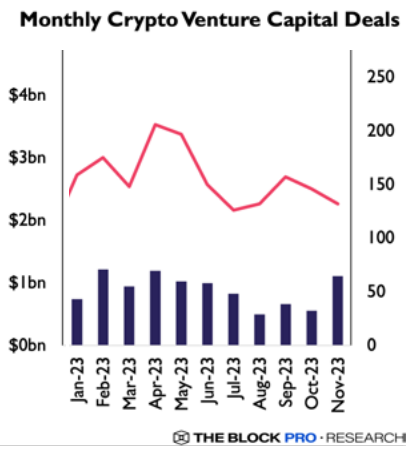

VC investment fell off a cliff in 2022 as the bear market and credit crises hit full stride. As I predicted in last year's report, 2023 saw a much smaller level of investment as VCs got excited by advancements in other tech areas such as artificial intelligence. Given that we're all expecting a bull market in 2024, we should also expect the VCs to return.

Venture Capital funding in the crypto industry dropped 66% year over year to $10.6 Billion, but remained 3X the flow seen in the previous bear market. pic.twitter.com/f7bl7yufb6

— Jameson Lopp (@lopp) December 22, 2023

As is historically the case during bear markets, BTC's exchange rate was more stable than most altcoins and thus it gained a relatively larger share of the overall market capitalization.

Bitcoin's market cap dominance increased from 40% to 53% during 2023. pic.twitter.com/wKiieKHVyN

— Jameson Lopp (@lopp) December 22, 2023

On the other hand, the "fast, cheap payments" narrative has not played out well for BCH. This is a highly competitive arena in which dozens if not hundreds of altcoins can claim to be "the best." And of course, Bitcoin itself continues to compete in this space via Lightning Network, which we'll cover later.

Despite a summer pump that more than doubled its value against BTC, the BCH fork closes out the year down another 9%. It's now worth a mere 0.5% of the real Bitcoin. Better luck next year, @rogerkver! pic.twitter.com/JUbbaJ3wBH

— Jameson Lopp (@lopp) December 22, 2023

Going down even further down the forking rabbit hole, BSV has been battered all year long as fewer and fewer folks are foolish enough to believe that Craig will be able to pull off a miracle and convince anyone who matters that he created Bitcoin.

The BSV fork managed to lose another 54% in value against BTC during 2023. It's now worth 0.1% the value of real Bitcoin. How many more millions will @CalvinAyre hemorrhage propping up Craig the clownish con man? 😬 pic.twitter.com/yzXy4JADgS

— Jameson Lopp (@lopp) December 22, 2023

On-Chain Transactions

While development of Lightning Network made more progress in 2023, due to its stronger privacy features we’ll always have more accurate statistics of on-chain activity.

Bitcoin's daily adjusted transfer value (excluding likely change outputs) remained quiet in 2023, under $10B per day, down more than 70% from the all-time high. pic.twitter.com/nmCRfZMF40

— Jameson Lopp (@lopp) December 22, 2023

A more controversial aspect of the changing nature of bitcoin is the transaction fees. Rising fees caused significant frustration for users trying to transact in smaller amounts of value during late 2017 and early 2018, but fees were nearly 0 for the following 2 years due to a variety of factors. Lower transaction demand, improved fee estimation algorithms, adoption of segregated witness, transaction batching, and lightning network resulted in more efficient use of block space and less contention for this scarce resource. In 2023 we saw both demand and fees spike to all-time highs!

Revenue collected via transaction fees by bitcoin miners averaged nearly $2,000,000 per day in 2023. This is up 400% year over year. pic.twitter.com/zZjUwy1Gbh

— Jameson Lopp (@lopp) December 23, 2023

Although transaction fees have exceeded the bitcoin subsidy for short periods in 2023, we still have a ways to go toward sustainable fee-based thermodynamic security. pic.twitter.com/viFeBsipWQ

— Jameson Lopp (@lopp) January 1, 2024

Demand for bitcoin block space was far more volatile in 2023. While there were plenty of periods in which a 1 sat/vb transaction would get confirmed, there were several months in which competitive fee rates lingered over 100X higher. pic.twitter.com/D59lxIVnTT

— Jameson Lopp (@lopp) December 23, 2023

Despite the bear market both for the exchange rate and block space, Bitcoin miners appear to be doing quite well.

Bitcoin miners earned over $10 billion in 2023, a significant addition to the $57 billion total over the past 15 years. This number assumes they instantly sell for fiat, which is most certainly not the case - miners are HODLers. pic.twitter.com/nfH8KI6etH

— Jameson Lopp (@lopp) December 23, 2023

Address reuse likely has a floor set on it due to the security mechanisms at exchanges. Some estimates have put nearly half of all bitcoin transactions as being exchange-related, and the deposit/withdrawal mechanisms of exchanges tend to encourage not generating new addresses. One of several side effects of Ordinals appears to be causing this number to rise again.

Bitcoin address reuse, which is a poor privacy practice, increased from 48% to 70% in 2023. This seems to coincide with the popularization of BRC-20 tokens. pic.twitter.com/nFn4ESUIvC

— Jameson Lopp (@lopp) December 23, 2023

SegWit adoption has reached saturation; last year I predicted it would take many years for us to asymptotically approach 100% adoption. Once again, Ordinals came out of nowhere and gave us a surprise.

Bitcoin transactions that spent SegWit inputs increased from 85% to 97% in 2023.

— Jameson Lopp (@lopp) December 24, 2023

𝕄𝕀𝕊𝕊𝕀𝕆ℕ 𝔸ℂℂ𝕆𝕄ℙ𝕃𝕀𝕊ℍ𝔼𝔻 pic.twitter.com/ViZxxGXPQH

UTXO set growth usually rises, but Ordinals have accelerated this metric as well due to their non-fungible nature. That is - people are minting tokens that are not being spent, much less consolidated with other UTXOs.

Bitcoin's UTXO set grew from 83.5M to 150M during 2023, adding 2 net additional UTXOs every second. pic.twitter.com/wXraSXk1v8

— Jameson Lopp (@lopp) December 24, 2023

Bitcoin Data Anchoring

While you may think of bitcoin as being a cryptocurrency, some users think of it as a trust anchor. By embedding data into Bitcoin’s blockchain, other systems can gain new properties such as tamper evidence and immutability.

The amount of outputs that embedded data into the blockchain increased at an unprecedented rate in 2019, mostly due to Veriblock's "proof of proof" mining coming online. However, since then we seem to be making a return to normal based upon what uses cases are economically justifiable. OP_RETURN creation dropped by another 5% in 2023.

Bitcoin OP_RETURN (data anchor) outputs created in 2023 dropped another 5% year over year to a total of 1,860,000. pic.twitter.com/9gkbvQ5DGD

— Jameson Lopp (@lopp) December 24, 2023

But OP_RETURN isn’t the only way to anchor other systems onto Bitcoin’s blockchain. Sidechains use pegging mechanisms to cryptographically lock BTC on the main chain and then allow users to unlock a proportional amount of tokens on a sidechain. This allows for experimentation with other features that are unlikely to be added to the Bitcoin protocol. At time of writing the only two production sidechains are RSK and Liquid. Work continues to progress on drivechains, though given their controversial natures it's hard to say if or when we'll see drivechains in production use.

The Bitcoin hashrate that is merge mining the @rootstock_io sidechain increased from 42% to 47% during 2023. (https://t.co/RWKM5Gd8dD)

— Jameson Lopp (@lopp) January 3, 2024

The amount of BTC pegged into rootstock decreased from 3,415 to 3,210. (https://t.co/MgPzrAfYdh)

Blockstream's Liquid sidechain also saw negligible growth in 2023.

During 2023 the amount of BTC pegged into the @Liquid_BTC sidechain increased by 5% to 3,753. pic.twitter.com/Y54pdafRgd

— Jameson Lopp (@lopp) January 3, 2024

Lightning Network

The observable network remained fairly flat in 2023. It seems like we saw some liquidity consolidation as plenty of channels were closed, but major operators seem to be reporting that they are able to achieve better results with less liquidity now.

Lightning Network in 2023:

— Jameson Lopp (@lopp) December 25, 2023

# advertised channels ⬇️ 23% to 65,635

# nodes with channels ⬇️ 3% to 16,603

Bitcoin in those channels ⬇️ 3% to 5,129

Network USD value ⬆️ 167% to $222M

NOTE: unadvertised channels and their value can't be measured.

Since we can't actually observe payments on the Lightning Network, we have to settle for anecdotal reports by major node operators about the volumes they're seeing.

River has seen 12X growth in routed lightning transactions the past 2 years and estimates that the network as a whole is currently sending half as many transactions off-chain as we see on-chain.

— Jameson Lopp (@lopp) January 3, 2024

Wen flippening? 🙃 pic.twitter.com/C8rcpaZxx2

Although the total number of advertised Lightning Network channels dropped slightly during 2023, the satoshi capacity of channels continued creeping up. Of course, denominated in fiat, channel capacity increased far greater than shown here. pic.twitter.com/BBvTIJmADJ

— Jameson Lopp (@lopp) December 25, 2023

DeFi

2022 saw a major unwind of lending activities and wrapped bitcoin bore some of the fallout - the trend appears to have continued this year. While many like to point out that there is "more bitcoin on Ethereum than Lightning Network" these figures are hardly comparable because the security models are completely different.

The total supply of wrapped bitcoin fell another 15% during 2023 and it now sits at a little under 156,000 WBTC. pic.twitter.com/PrqvEgFQLN

— Jameson Lopp (@lopp) December 25, 2023

The vast majority of wrapped bitcoin are in fact custodied by BitGo for their WBTC token, so I think of this metric as more akin to a "balances on exchanges" metric.

While Rootstock and Stacks increased the total value locked in their ecosystems, the biggest loser of 2023 was DeFiChain. pic.twitter.com/PodR980YID

— Jameson Lopp (@lopp) January 2, 2024

What is DeFiChain? Apparently it's a proof of stake sidechain. I haven't heard much about it, but from browsing forums it sounds like they've had some trouble lately. It had some algorithmic stablecoins that depegged and there are legal and reputation issues with the organization that's behind it.

Network Security and Health

The number of Bitcoin nodes remained steady in 2023; I'd say this is a pretty strong floor of dedicated operators (such as myself!) who will continue running nodes for our own benefit regardless of the exchange rate.

Reachable Bitcoin node count increased by 7% during 2023 to 16,446 according to @port8333. pic.twitter.com/Btato8pAu2

— Jameson Lopp (@lopp) December 27, 2023

The number of unreachable nodes (behind routers without port forwarding) was started to rise in Q4. This is more evidence of a floor of dedicated Bitcoiners who have persevered through the bear market. Last year I said that I expect this number to be an indicator of retail FOMO and that it will shoot up if a bunch of newbies enter the space. It looks like that trend has begun...

According to @LukeDashjr's estimates of unreachable / non-listening node counts, the total number of Bitcoin nodes increased from 47,000 to 65,000 during 2023. pic.twitter.com/lAJQnljIqJ

— Jameson Lopp (@lopp) December 26, 2023

A variety of improvements in block propagation have been implemented by Bitcoin Core over the past several years; network propagation performance has been fairly consistent since 2019.

Bitcoin block propagation times improved by 20% year over year, as the average block took 495 milliseconds to reach half of the nodes on the network. pic.twitter.com/xlIwXdbu8x

— Jameson Lopp (@lopp) December 27, 2023

Bitcoin transaction propagation times were 10% slower year over year; the average transaction takes nearly 5 seconds to reach half the nodes on the network. This is intentionally slower than it once was, with nodes injecting random delays to improve network privacy. pic.twitter.com/utRdYPsqgk

— Jameson Lopp (@lopp) December 27, 2023

Next we have a new metric that bitnodes started tracking this year. This is relevant due to issues I've seen while syncing, caused by nodes that have extremely low bandwidth.

The median and average Bitcoin node's bandwidth nearly doubled during 2023. pic.twitter.com/oETgj6LoCZ

— Jameson Lopp (@lopp) December 28, 2023

As we can see, the average reachable Bitcoin node has pretty limited upstream bandwidth. Why is this the case? Because most nodes are run at home, on residential ISPs that tend to significantly throttle upstream speeds. Also, around 60% of reachable nodes are operating over the tor network, which is fairly slow by design - your data has to hop through multiple tor nodes before reaching its destination. Why did we see a doubling in upstream? There are a variety of potential answers that are all speculative:

- Perhaps residential ISPs are raising their upstream caps

- Perhaps more nodes are being run from data centers (doesn't look like this is the case)

- Most plausible: the tor network's performance has increased. This makes sense, as tor was under a sustained denial of service attack for the past year and they ended up adding proof of work defenses for onion services.

Moving on to thermodynamic security: the network hashrate has continued its upward trajectory to all-time highs.

Bitcoin's network hashrate increased by 102% during 2023, from 256 to 517 exahash per second. pic.twitter.com/U0V8pnoqgK

— Jameson Lopp (@lopp) January 1, 2024

The proof-of-work equivalent days is an interesting metric though it should not be construed as a reasonable attack that we should be worried about. Theoretically an attacker could have 1,000% of the total network hashrate or more and perform various block reorganization and double spending attacks. Practically, of course, there are physical limitations to acquiring that level of hardware and electricity.

Bitcoin POW Equivalent Days fell during 2023 as a result of the massive hashrate increase.

— Jameson Lopp (@lopp) January 1, 2024

An attacker with 100% of the current hashrate would have to spend over 600 days mining privately in order to accumulate enough cumulative POW to rewrite the entire blockchain. pic.twitter.com/7j5cdzHpYg

The growth in global hashrate has been not merely increasing, but has been accelerating since genesis.

Bitcoin's thermodynamic security accelerated at an average rate of 8,276 GH/s^2 in 2023. https://t.co/gEeNFBK4ke

— Jameson Lopp (@lopp) January 1, 2024

I'm pleased to report that this prediction I made last year was wrong:

from recent reports we can see that a lot of the newer industrial mining operations are now in distress due to overleveraging their operations. I'd expect that 2023 will see a delayed fallout and thus slower network growth as some of these larger operations go out of business and are acquired by the survivors.

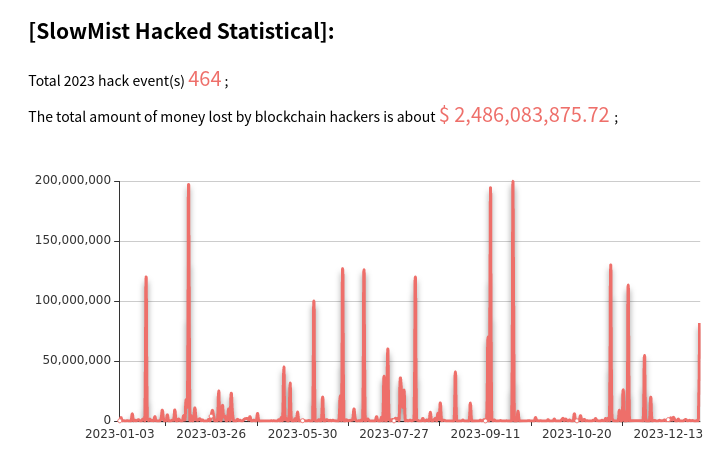

In terms of general ecosystem security, 2023 was an amazing year! Major hacks cause loss in confidence in the system and can serve as major setbacks even though they have nothing to do with the protocol or network security.

Bitcoin custody practices continue to improve, and as such 2023 saw a new all-time low in major thefts. Only 0.005% of the total money supply was stolen in publicly reported hacks! pic.twitter.com/4Z50dT5k5Z

— Jameson Lopp (@lopp) December 29, 2023

This metric of loss due to hacks is really showing a dividing line between "bitcoin" and "crypto" - as there were hundreds of hacks worth nearly $2.5B during 2023.

Yet, as far as I can tell, less than $100M of those thefts were of BTC. Which means that only ~5% of the hacks in this space are against BTC, which is quite amazing given that BTC comprises over 50% of the market value of the entire ecosystem. What's the explanation for this? I think it's pretty straightforward: high value hacks tend to exploit weaknesses in complex smart contracts, bridges, and apps that haven't been thoroughly vetted. Bitcoin's relative simplicity makes it more secure, so attackers move on to softer targets.

Physical attacks tend to be correlated with the exchange rate; the bear market has reduced the risk of attack (for now.)

Physical attacks against crypto asset owners, which tend to be correlated with exchange rates, were predictably lower in 2023. pic.twitter.com/qx8cv9ZZAo

— Jameson Lopp (@lopp) December 22, 2023

Cost of Node Operation

Anyone who has been following the Bitcoin space for long is likely aware of the scaling debate that resulted in a variety of both software forks and blockchain forks.

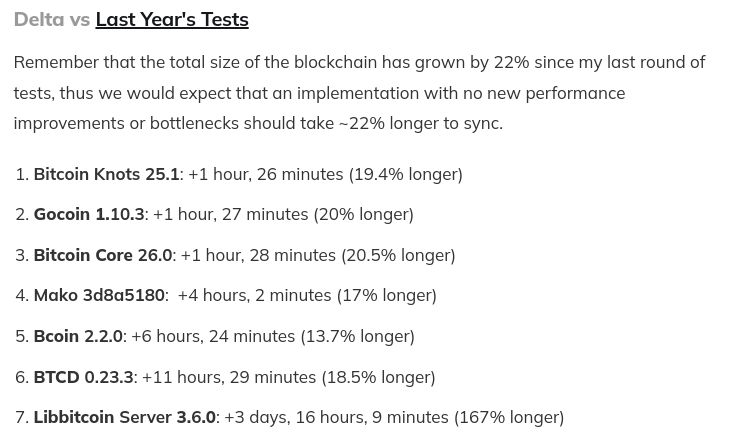

I ran performance tests of every Bitcoin client and all but one held up well in 2023. Note that inscription transactions don't actually require much in terms of CPU cycles to validate them. Since CPU tends to be the bottleneck for syncing if your node has plenty of RAM, my benchmarks showed that sync times did not slow down as much as the blockchain grew.

In terms of total storage required, the annual blockchain growth rate increased to 21%, bucking the trend of going down year over year. And of course you can always run a pruned node (though it will still have to download all of the data during the initial sync) that only needs 10 GB or so.

During 2023 the Bitcoin blockchain grew from 446.2GB to 537.9GB - an annual growth rate of 20.6% pic.twitter.com/5ufIyxMM8r

— Jameson Lopp (@lopp) January 1, 2024

Bitcoin Economics

As usual, many of Bitcoin's economic metrics were correlated to the exchange rate, which went sideways for much of the year.

Bitcoin's 30 & 60 day exchange rate volatility averaged under 2% during 2023 - an all-time low! pic.twitter.com/HHxQb69Myv

— Jameson Lopp (@lopp) December 29, 2023

The median on-chain bitcoin transaction value dropped from $90 to $15 in 2023. This is clearly a result of the popularization of ordinals that tend to have low transaction output values. pic.twitter.com/mstaXf2vlc

— Jameson Lopp (@lopp) January 1, 2024

.@coinmetrics estimates (by removing likely change outputs) that $1.4T was transferred via the Bitcoin blockchain in 2023, averaging $45,000 per second. pic.twitter.com/DH73M9t74K

— Jameson Lopp (@lopp) January 1, 2024

From a relative historical standpoint, the overall delta in exchange rate was typical for the transition period from bear to bull market.

The average DAILY delta for the bitcoin exchange rate continues an interesting pattern... pic.twitter.com/qkckOoYp9a

— Jameson Lopp (@lopp) January 1, 2024

To calculate the above, use the formula:

Jan 1 exchange rate * (x³⁶⁵)=Dec 31 exchange rate

Microstrategy keeps buying bitcoin!

Bitcoin known to be held on corporate balance sheets at the close of each year. pic.twitter.com/DTlxSNnvMl

— Jameson Lopp (@lopp) December 30, 2023

Accumulation intensifies: addresses with balances of 1 BTC or more exceeded 1,000,000 in 2023. pic.twitter.com/m260DNwJwV

— Jameson Lopp (@lopp) December 30, 2023

The number of up-to-date merchants accepting BTC cataloged by @btcmap increased 174% in 2023. pic.twitter.com/EVHXHdmqkK

— Jameson Lopp (@lopp) January 7, 2024

Bitcoin Trading

ATM deployment declined for the first time in the history of Bitcoin. Based upon the comments I received, this is most likely a result of the UK completely banning them. Others noted that ATMs are hot targets for perpetuating scams like pig butchering and scareware and often aren't worth the hassle to retail locations that host them.

The number of operational Bitcoin ATMs dropped for the first time year over year, declining 14% to 33,620. pic.twitter.com/0N6V9P8KBM

— Jameson Lopp (@lopp) December 30, 2023

Trading volume on spot exchanges remained flat throughout 2023 even as the exchange rate doubled. pic.twitter.com/bSBHTnZSME

— Jameson Lopp (@lopp) January 2, 2024

Exchange balances didn't change much in 2023; everybody was HODLing.

Bitcoin balances on exchanges (estimated via on-chain heuristics) stayed in a tight range during 2023, ending the year down 2% to 2,327,580 according to @glassnode. pic.twitter.com/ZcblJvnFB3

— Jameson Lopp (@lopp) December 30, 2023

As an aside, I do have some commentary on "entity" based on-chain metrics such as balances held on exchanges. These heuristics are imperfect in their sense that they tend to become more accurate with more hindsight. That is, if an exchange sends a bunch of funds to a never-before-seen cold storage address, it can't be attributed to them until at some point in the future when they spend the funds. As such, when I went back and checked my previous year's reporting on this metrics, the numbers have changed! Last year I reported a 20% decrease in balances:

Bitcoin balances on exchanges (estimated via on-chain heuristics) dropped 20% from 2,821,054 to 2,244,941 during 2022 according to @glassnode. pic.twitter.com/zjePlecJiy

— Jameson Lopp (@lopp) December 22, 2022

When I went back to check on the 2022 numbers I noted that they showed a drop of 17% from 2,864,640 BTC to 2,362,983; note that the closing number was adjusted upward by over 100,000 BTC. Point being: these metrics tend to be directionally correct, just not particularly precise.

The @BitMEX insurance fund only grew by 0.3% (100 BTC) in 2023. It holds 0.19% of all BTC. pic.twitter.com/j5UIYekiUM

— Jameson Lopp (@lopp) December 31, 2023

Open interest in various Bitcoin contracts is back on the rise.

Open interest in bitcoin perpetual and futures contracts increased 75% during 2023 to $11.2 billion. pic.twitter.com/lEAERyOv5O

— Jameson Lopp (@lopp) December 31, 2023

Inscriptions & Ordinals

Inscriptions certainly had an impact on the Bitcoin ecosystem this year. They caused a spike in block space being used, created high demand and thus transaction fees, accelerated growth of the UTXO set, and of course kicked off another round of debates over what should constitute "spam."

Nearly 53M inscriptions were stored on the Bitcoin blockchain in 2023. pic.twitter.com/FSsM2zBIpv

— Jameson Lopp (@lopp) January 1, 2024

Inscriptions consumed ~20% of Bitcoin's block space in 2023, but they paid their fair share of fees. 22.4% of all transaction fees (5,327 BTC of 23,445 total) were paid by inscribers. pic.twitter.com/tJgzluTIT8

— Jameson Lopp (@lopp) January 1, 2024

What do I think will happen regarding ordinals in the coming years?

- Don't expect any protocol / node changes that attempt to block inscriptions. Rough consensus amongst the technical community is that this is not a battle worth fighting.

- Given the impending bull market, I don't think we'll see this ecosystem wither in 2024 - it may actually go more wild due to hype and FOMO.

- I expect history will eventually repeat itself and the overwhelming majority of ordinals projects will fail to find a sustainable product market fit. But a few of them may stick around.

- It will be fascinating to see how much time some folks waste whining about people using Bitcoin in ways of which they disapprove. I myself am already weary of these unproductive discussions.

Technical Development

At a protocol level, there was a decent amount of research done in 2023. If you want a deep dive into low level developments I recommend reading Bitcoin Optech's year-in-review. I have been delighted to see renewed interest and discussion toward activating various soft fork proposals that will further improve the security and scalability of the protocol.

Email volume to the Bitcoin Development Mailing List was down 40% year over year. pic.twitter.com/fN9QKkYwk2

— Jameson Lopp (@lopp) January 5, 2024

Message volume on the bitcoin core development IRC was down 29% year over year. pic.twitter.com/dwMrkMoV55

— Jameson Lopp (@lopp) January 5, 2024

The Bitcoin Core project continues to improve.

Bitcoin Core code commits were down slightly during the bear market. pic.twitter.com/c0yzjSVYR9

— Jameson Lopp (@lopp) January 2, 2024

Source: calculated from the default development git branch:

git shortlog --after 2023-01-01 --summary --numbered --no-merges

This metric was a bit surprising considering the other downtrends:

Despite having fewer active contributors in recent years, the pace of development in Bitcoin Core appears to be accelerating. pic.twitter.com/a9ypbmMjSX

— Jameson Lopp (@lopp) January 2, 2024

I did some further analysis into last year's code changes, and the bulk of them were actually related to localization in the GUI.

Here you can visualize the year's activity in the Bitcoin Core code repository:

To generate the above (on Linux):

- Build & install gource

- Clone the bitcoin gources repository

- Run the "grab avatars" script from the Bitcoin Core repository

- Run: gource --start-date "2023-01-01" --stop-date "2023-12-31" -1920x1080 -r 60 --seconds-per-day 0.5 --date-format "%B %d %Y" --user-image-dir ../bitcoin/.git/avatar/ --default-user-image gource/avatar/default.png --output-ppm-stream - --caption-file gource/caption.txt --caption-size 24 --caption-duration 4 ../bitcoin/ | ffmpeg -y -r 60 -f image2pipe -vcodec ppm -i - -vcodec libx264 -preset ultrafast -pix_fmt yuv420p -crf 1 -threads 0 -bf 0 bitcoin_core_gource.mp4

Conclusion

Most people are only familiar with the exchange rate of Bitcoin, if that. But exchange rate is just one of many metrics we can use to observe the evolution of this ecosystem. While any given metric can be gamed or may be taken from sources that aren’t 100% reliable, by using a diversity of metrics and sources we can get a rough idea of the trends in this space.

2023 was a recovery year for the ecosystem. As I predicted last year:

"those of us who are dedicated to this system shall continue to BUIDL and add value; we have no control over the market but I expect that sentiment will rebound and we'll see another wave of adoption by the masses who need it most."

My overall prediction for 2024 is that it's going to be quite exciting!

“Every day that goes by and Bitcoin hasn’t collapsed due to legal or technical problems, that brings new information to the market. It increases the chances of Bitcoin’s eventual success and justifies a higher price.” - Hal Finney