Bitcoin 2020 Annual Review

I’ve always been fascinated with the raw numbers relating to the operational status and growth of Bitcoin, especially as we ride the rollercoaster of the adoption life cycle. This interest spurred me to create Statoshi.info in 2014 to track bitcoin metrics from the perspective of a full node.

To that same end, I’ve compiled statistical measurements of Bitcoin’s growth in 2020 from a variety of sources. It is difficult to see all of the moving pieces since the data is so distributed, but the picture becomes clearer when you bring them all together.

The one theme that I've taken away from all of these metrics is that 2020 was a growth year for Bitcoin. 2019 was a quiet year of building; 2020 is when we saw perseverance pay off once again.

Bitcoin is at the forefront of an increasingly complex ecosystem that continues to grow in a variety of ways. And for the 12th straight year, it stubbornly refused to die!

RIP Bitcoin Obituaries:

— Jameson Lopp (@lopp) December 23, 2020

2010: 1

2011: 6

2012: 1

2013: 17

2014: 29

2015: 39

2016: 28

2017: 124

2018: 93

2019: 41

2020: 10https://t.co/K8Gna8iA4D

General Interest

Relative search interest remains high in developing countries.

Countries with the most relative search interest for Bitcoin remained unchanged between 2019 and 2020. pic.twitter.com/gRyKhU573c

— Jameson Lopp (@lopp) December 23, 2020

General interest in educational resources remained low. This leads me to believe that recent growth in the exchange rate is spurred by a smaller number of high value investors rather than a flood of retail FOMO.

270 average daily visitors viewed https://t.co/8ZsrcEwSfa this year, only 10% higher than 2019. pic.twitter.com/nCUl1n1Rz7

— Jameson Lopp (@lopp) December 24, 2020

Twitter chatter was similarly modest in terms of volume.

28 million tweets containing the word "bitcoin" were posted in 2020 - an increase of 29% over 2019.

— Jameson Lopp (@lopp) December 28, 2020

H/T @wullon pic.twitter.com/uTC5QuGhid

The bitcoin subreddit saw pretty decent growth, though it's hard to tell how real or active these accounts are. The volume of comments and posts per day on reddit remained pretty much on par with the volume seen in 2020 until we surpassed the all-time high in December. So this could be an influx of lurkers or a bunch of bots.

Subscribers to /r/bitcoin increased 49% during 2020 to a total of 1,840,000. pic.twitter.com/SRp8S7jR4c

— Jameson Lopp (@lopp) December 24, 2020

I myself abandoned BitcoinTalk many years ago because I felt it was hard to find signal through the noise. It looks like user growth on that site continues to decelerate.

BitcoinTalk total registered users:

— Jameson Lopp (@lopp) December 24, 2020

2009: 19

2010: 3,127

2011: 48,827

2012: 76,680

2013: 207,357

2014: 406,833

2015: 710,256

2016: 935,550

2017: 1,346,000

2018: 2,464,000

2019: 2,718,000

2020: 2,916,000

Academic Interest

Academic interest continued to increase, which is great for the long-term prospects of this industry as we continue to gain a greater understanding of what we’re building.

Google Scholar articles published mentioning Bitcoin:

— Jameson Lopp (@lopp) December 24, 2020

2009: 83

2010: 136

2011: 218

2012: 424

2013: 868

2014: 2,070

2015: 2,820

2016: 3,380

2017: 6,460

2018: 11,500

2019: 20,300

2020: 18,900 (will ⬆️ due to listing lag)

Cryptology ePrint Archive papers mentioning Bitcoin:

— Jameson Lopp (@lopp) December 24, 2020

2011: 1

2012: 3

2013: 8

2014: 18

2015: 20

2016: 26

2017: 24

2018: 26

2019: 20

2020: 24

Funding and Forking

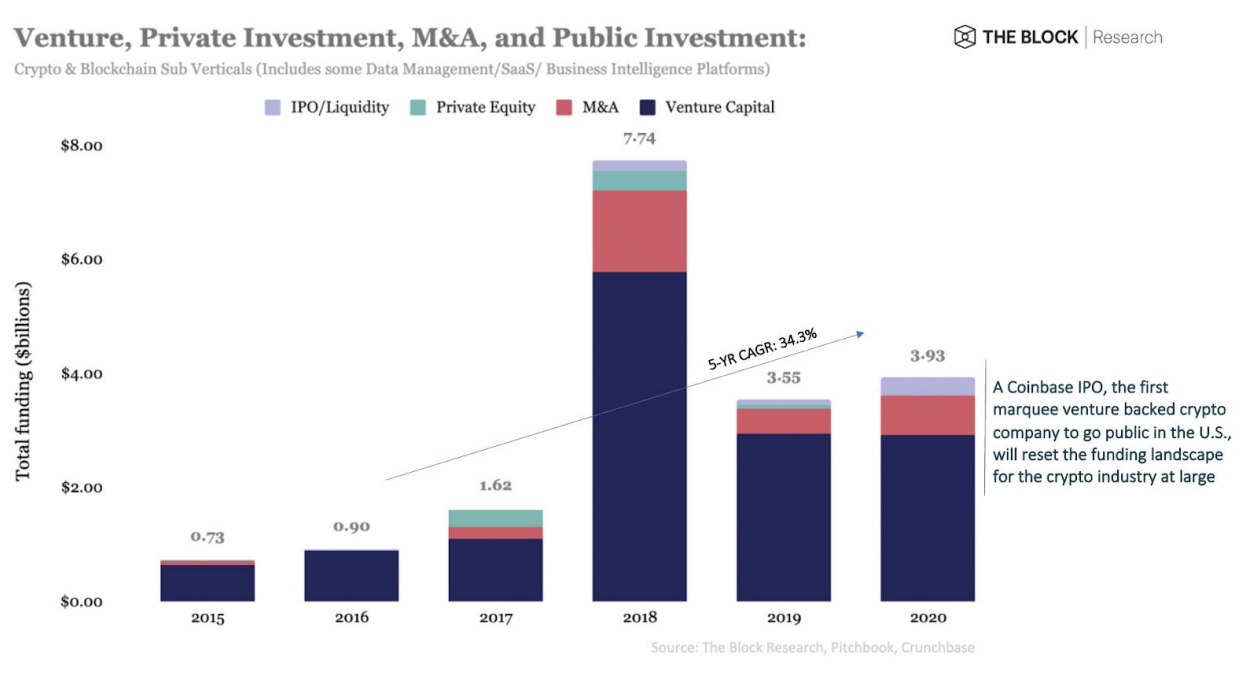

Venture capital funding is back on the rise as the companies that survived the bear market have proven and fine tuned their business models.

Crypto industry venture capital funding:

— Jameson Lopp (@lopp) December 23, 2020

2012: $23M

2013: $120M

2014: $368M

2015: $850M

2016: $850M

2017: $1,200M

2018: $6,000M

2019: $3,000M

2020: $3,500M

The red hot ICO market crashed by another 97% after crashing 85% in 2019 as many overfunded overhyped projects failed to deliver on their promises. An uptick in SEC action against ICO companies certainly didn't help.

Funds raised via ICOs:

— Jameson Lopp (@lopp) December 25, 2020

2014: $30M

2015: $9M

2016: $257M

2017: $6,558M

2018: $21,621M

2019: $3,255M

2020: $95M

(Almost all of the ICO stats sites are offline; 2020 number could be a bit higher.)

Although bitcoin's exchange rate quadrupled over the course of the year, volatility was fairly low with the exception of Black Thursday.

With the exception of the Black Thursday crash, Bitcoin's exchange rate volatility stayed relatively low throughout 2020, hovering around 2.5% for trailing 30 and 60 day price changes. https://t.co/KmrSmVDdow pic.twitter.com/jAY0SLtUGe

— Jameson Lopp (@lopp) December 25, 2020

I saw quite a few calls for "alt season" to kick off throughout 2020, but it simply hasn't happened. My primary explanation for this is that "alt season" happens when there is retail FOMO and a lot of those newcomers feel like they missed the boat to buy bitcoin and thus they need to find "the next Bitcoin." That hasn't played out in 2020, as it appears much of the growth is driven by institutional investors and high net worth individuals who are seeking safety in sound money rather than riskier new tokens.

Bitcoin market cap dominance (a highly manipulable metric of questionable value) never dipped below 55% in 2020 . The combined market caps of the thousands of altcoins failed to reach that of Bitcoin. pic.twitter.com/b3d0Sr3xNs

— Jameson Lopp (@lopp) December 25, 2020

The "fast, cheap payments" narrative has not played out well for BCH and BSV. This is a highly competitive arena in which dozens if not hundreds of altcoins can claim to be "the best." And of course, Bitcoin itself continues to compete in this space via Lightning Network.

2020 was a bad year to be a forkcoiner.

— Jameson Lopp (@lopp) December 25, 2020

📉 $BCH 📉 $BSV 📉 pic.twitter.com/E2VOzedAsC

On-Chain Transactions

While development of Lightning Network made more progress in 2020, which I’ll cover later on, due to its stronger privacy features we’ll always have more accurate statistics of on-chain activity.

Bitcoin daily on-chain value transferred hit $20B, on par with the summer 2019 top.

— Jameson Lopp (@lopp) December 28, 2020

Meanwhile daily adjusted on-chain value transferred hit $10B, on par with the 2017 market cycle top. pic.twitter.com/04dkeblcGu

On-chain transfer volume in bitcoin terms remained even flatter in 2020 than in 2019; the notable exception being Black Thursday in March. pic.twitter.com/fl1VuHwgQZ

— Jameson Lopp (@lopp) December 28, 2020

Daily bitcoin transaction outputs trended up slightly throughout 2020. https://t.co/9f6shMikYh pic.twitter.com/QacUkgjeN7

— Jameson Lopp (@lopp) December 28, 2020

Over the course of 2020 BTC added over $300B to its market cap. The amount of daily active addresses doubled, and the number of addresses holding at least 0.01 BTC grew by over 700k. pic.twitter.com/4dHpdkiAHF

— Nate Maddrey (@natemaddrey) December 22, 2020

A more controversial aspect of the changing nature of bitcoin is the transaction fees. Rising fees caused significant frustration for users trying to transact in smaller amounts of value during late 2017 and early 2018, but fees were nearly 0 for the following 2 years due to a variety of factors. Lower transaction demand, improved fee estimation algorithms, adoption of segregated witness, transaction batching, and lightning network resulted in more efficient use of block space and less contention for this scarce resource. In 2020 we saw demand increase and fees followed suit.

Revenue collected via transaction fees by bitcoin miners has increased from under $100k / day to $2M+ per day in 2020. pic.twitter.com/kvOKHQmD29

— Jameson Lopp (@lopp) December 28, 2020

Bitcoin miners have earned over $21 billion in revenue throughout the 11 year operation of the network. This number assumes they instantly sell for fiat, which is most certainly not the case - miners are HODLers. pic.twitter.com/ZUJ0uNbsxK

— Jameson Lopp (@lopp) December 29, 2020

You can see the market for bitcoin block space coming back to life from this year's historical fee rate estimates. https://t.co/vQ3H6QiBQp pic.twitter.com/joN66XAqUt

— Jameson Lopp (@lopp) December 28, 2020

Address reuse likely had a floor set on it due to the security mechanisms at exchange. Some estimates have put nearly half of all bitcoin transactions as being exchange-related, and the deposit/withdrawal mechanisms of exchanges tend to encourage not generating new addresses.

Bitcoin address reuse, which is a poor privacy practice, continued its downward trend in 2020. However, 43% of addresses receiving deposits are being reused! https://t.co/OA3oIhHeIj pic.twitter.com/GlWy9yTa5P

— Jameson Lopp (@lopp) December 25, 2020

The rising on-chain fees will hopefully encourage further adoption of SegWit. Binance finally added support for it at the end of 2020, though they don't appear to have made it the default. The largest transaction creator that I'm aware of that still has not added support is blockchain.com - don't use them as a wallet unless you like paying higher transaction fees!

SegWit adoption continues to grind forward; two thirds of all bitcoin transactions now are SegWit spends. pic.twitter.com/k9qw2V1plR

— Jameson Lopp (@lopp) December 25, 2020

UTXO set growth continued its growth trend from 2019. This is hopefully another indication of individual users taking ownership of their private keys.

Bitcoin's UTXO set rose from 64.5M to an all-time high of 69.1M in 2020, adding a net new UTXO every 8 seconds. pic.twitter.com/J23pSphXtW

— Jameson Lopp (@lopp) December 26, 2020

Bitcoin Data Anchoring

While you may think of bitcoin as being a cryptocurrency, some users think of it as a trust anchor. By embedding data into Bitcoin’s blockchain, other systems can gain new properties such as tamper evidence and immutability.

The amount of outputs that embedded data into the blockchain increased at an unprecedented rate in 2019, mostly due to Veriblock's "proof of proof" mining coming online. However, 2020 seems to have shown that this model was not sustainable during periods of higher demand for block space that cause transaction fees to rise significantly. OP_RETURN creation dropped by 72% year over year.

Bitcoin OP_RETURN (data anchor) outputs created in:

— Jameson Lopp (@lopp) December 26, 2020

2014: 13,000

2015: 655,000

2016: 1,040,000

2017: 2,253,000

2018: 6,750,000

2019: 28,200,000

2020: 7,830,000

Here you can see OP_RETURN outputs dropping throughout 2020 as @VeriBlock continued to scale back its usage. Two years ago they were creating 20% of all bitcoin transactions; now they're around 1%. pic.twitter.com/vsYyKoz9Cn

— Jameson Lopp (@lopp) December 26, 2020

But OP_RETURN isn’t the only way to anchor other systems onto Bitcoin’s blockchain. Sidechains use pegging mechanisms to cryptographically lock BTC on the main chain and then allow users to unlock a proportional amount of tokens on a sidechain. This allows for experimentation with other features that are unlikely to be added to the Bitcoin protocol. At time of writing the only two production sidechains are RSK and Liquid. Work continues to progress on drivechains, though it's hard to say if and when we'll see drivechains in production use.

The Bitcoin hashpower that is merge mining the @RSKsmart sidechain increased from 57% to 62% in 2020 https://t.co/RWKM5Gd8dD

— Jameson Lopp (@lopp) December 26, 2020

The amount of BTC pegged into rootstock increased from 162.4 to 546.3 https://t.co/MgPzrAfYdh

During 2020 the amount of BTC pegged to the @Blockstream Liquid sidechain increased from 96 to 2,600. https://t.co/610iGLrdN2 pic.twitter.com/p9eVrpM1WR

— Jameson Lopp (@lopp) December 26, 2020

Lightning Network

The observable network grew modestly in 2020. It's also becoming more difficult to know how accurate the metrics are for Lightning Network as more channels are being created privately.

During 2020:

— Jameson Lopp (@lopp) December 28, 2020

# advertised Lightning Network channels ⬆️ 5% to 38,000.

Bitcoin in those channels ⬆️ 22% to 1,060 BTC.

Network total USD value ⬆️ 322% to $26M.

NOTE: unadvertised channels and their value can't be measured.https://t.co/EeOlkEEHvQ pic.twitter.com/kCYglQk4wD

Lightning Network density decreased throughout 2020 while cut channels increased from 32% to 42%. Seems like too sparse of a network could create fragility / routing challenges, but not sure what the optimal levels are. pic.twitter.com/azD3K4ics0

— Jameson Lopp (@lopp) December 28, 2020

3) Huge protocol gains:

— Ryan Gentry (@RyanTheGentry) December 23, 2020

✅ Multi-Path Payments became the standard

✅ LSATs were introduced (https://t.co/l48140tqjM)

✅ Keysend was enabled, leading to @sphinx_chat

✅ PSBT support lowered hot wallet risk

✅ Anchor channels lowered counterparty risk

✅ WUMBO channels enabled! pic.twitter.com/wqIyU35abN

In 2018 my grand total of Lightning Network routing fee earnings was about $20 in return for forwarding 5000 payments

— Alex Bosworth (@alexbosworth) December 25, 2020

2019: year routing fee earnings increased to about $200 in return for forwarding ~15,000 payments

2020: year revenue increased to about $2500 on 70,000 payments

Not good with charts so I didn't aggregate, but in 2020 my forwarding fees earned on my @YallsOrg nodes rose steadily through the year.

— Alex Bosworth (@alexbosworth) December 31, 2020

LN utility should grow as a function of users. 1 new store at 100 users is 100 potential for commerce. 1 new store at 1k users is 1k potential. pic.twitter.com/ZQhckmzST9

DeFi

2020 was a big year for folks building financial infrastructure on Ethereum and Bitcoin wasn't left out. While many like to point out that there is "more bitcoin on Ethereum than Lightning Network" these figures are hardly comparable because the security models are completely different.

Over $3B worth of BTC was tokenized on ethereum this year. Worth noting that practically all of this bitcoin is held by custodians. pic.twitter.com/XSiDghwAPp

— Jameson Lopp (@lopp) December 25, 2020

Network Security and Health

The number of Bitcoin nodes held steady during the bear market — my suspicion is that people who run reachable nodes are highly dedicated to Bitcoin and/or using them for economic purposes, thus they are unlikely to turn off the node due to exchange rate volatility.

Reachable Bitcoin node count has remained fairly flat during 2020, in the 10k - 11k range. The volatility seen on @port8333's chart is due to some wonkiness with counting nodes on the tor network. https://t.co/YdrWxV3xhP pic.twitter.com/1v2g3z9oP2

— Jameson Lopp (@lopp) December 27, 2020

The number of unreachable nodes (behind routers without port forwarding) was also fairly steady. This is probably evidence of a node floor of dedicated Bitcoiners who have persevered through the bear market. I fully expect this number to be an indicator of retail FOMO and that it will shoot up if a bunch of newbies enter the space.

According to @LukeDashjr's estimates of unreachable / non-listening node counts, the total number of Bitcoin nodes also stayed flat in the 50,000 range during 2020. https://t.co/LwwSVN2y5T pic.twitter.com/TfNQ7QtXmV

— Jameson Lopp (@lopp) December 27, 2020

A variety of improvements in block propagation have been implemented by Bitcoin Core over the past several years; network propagation performance leveled off in 2019. It looks like latency ticked up a bit and there was about 1 orphaned block per month on the network, which is still incredibly low in historical terms.

Bitcoin block propagation slowed down by about 50% this year (200 milliseconds.) The slowdown appears to coincide with the decommissioning of the FIBRE high performance relay network this summer, but correlation doesn't prove causation. https://t.co/u15SGDEF6b pic.twitter.com/xPFJNWe79N

— Jameson Lopp (@lopp) December 29, 2020

Given that the exchange rate quadrupled, it's not surprising to see the hashrate increasing. Continued improvements in hardware efficiency also serve to lower the electricity required to achieve a given hashrate. However, I believe that we're currently seeing a lag in hashrate increase due to a supply shortage of ASICs. I expect 2021 will see a major uptick in hashrate as more machines come online.

Bitcoin's network hashrate increased by 41% during 2020, from 113 to 159 exahash per second. https://t.co/bGirYxrO3g pic.twitter.com/wtXTt8pMQV

— Jameson Lopp (@lopp) December 31, 2020

Use of AsicBoost also serves to increase miners' electrical efficiency.

Usage of overt "version-rolling" AsicBoost by Bitcoin miners appears to have leveled off around 70% in 2020. https://t.co/DS7eatUoRQ pic.twitter.com/wqAeY5ZArw

— Jameson Lopp (@lopp) December 27, 2020

The proof-of-work equivalent days is an interesting metric though it should not be construed as a reasonable attack that we should be worried about. Theoretically an attacker could have 1,000% of the total network hashrate or more and perform various block reorganization and double spending attacks. Practically, of course, there are physical limitations to acquiring that level of hardware and electricity.

BITCOIN POW EQUIVALENT DAYS HITS ALL TIME HIGH!

— Jameson Lopp (@lopp) December 27, 2020

An attacker with 100% of the current hashrate would have to spend over 550 days mining in order to accumulate enough work to rewrite the entire bitcoin blockchain. https://t.co/fm3inll7uV pic.twitter.com/n5uFzsnmeQ

This is actually the first year since I've started tracking annual network hashrate growth that the acceleration has slowed down. We are still accelerating of course, and I expect that 2021 will accelerate growth even faster as ASIC production ramps up.

Bitcoin's thermodynamic security accelerated at an average rate of 1,458 GH/s^2 in 2020. https://t.co/7yXYzG8Vlz

— Jameson Lopp (@lopp) December 31, 2020

In terms of general ecosystem security, 2020 was an amazing year! Major hacks cause loss in confidence in the system and can serve as major setbacks even though they have nothing to do with the protocol or network security.

Bitcoin security appears to be improving! As far as I can tell, only 4,366 BTC was stolen in major publicly announced thefts during 2020. This is a 92% drop from 2019 and an all-time low of only 0.02% of the total supply.

— Jameson Lopp (@lopp) December 29, 2020

I'm tracking thefts here: https://t.co/gdSKj6cvEy pic.twitter.com/CJpsZrcsJO

Cost of Node Operation

Anyone who has been following the Bitcoin space for long is likely aware of the scaling debate that resulted in a variety of both software forks and blockchain forks. The good news for node operators is that it appears the resources required to fully validate the entire history of the blockchain are decelerating, meaning that node operators should be able to take advantage of the deflationary nature of technology.

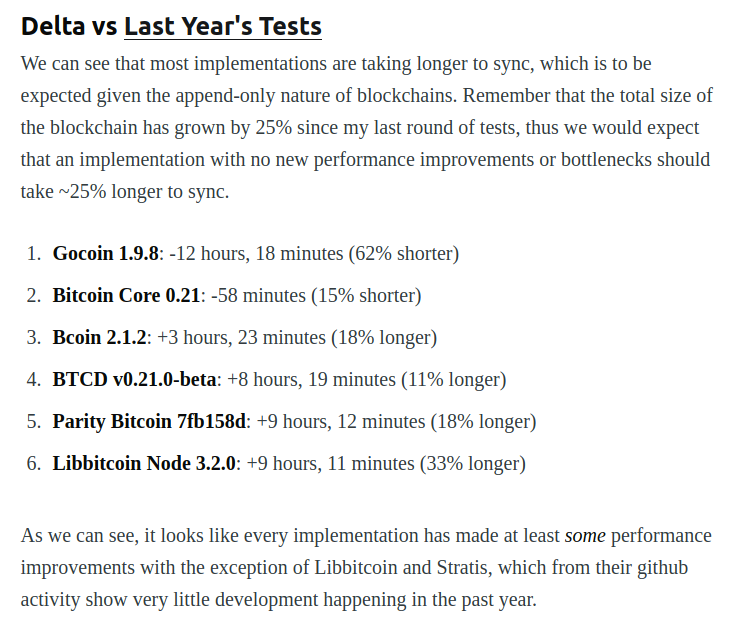

I ran performance tests of every Bitcoin client and sync time actually decreased or remained steady (linearly increasing along with the total blockchain size) for all but one client.

In terms of total storage required, the annual blockchain growth rate is now down to 25%, which ought to be easily addressed by increasing hard drive density. And of course you can always run a pruned node (though it will still have to download all of the data during the initial sync) that only needs 10 GB or so.

During 2020 the Bitcoin blockchain grew from 256GB to 319GB - an annual growth rate of 25%.https://t.co/DPUJ8meguX pic.twitter.com/dB8oasOWQG

— Jameson Lopp (@lopp) December 30, 2020

Bitcoin Economics

As usual, many of Bitcoin's economic metrics were correlated to the exchange rate, which was fairly flat until the 4th quarter of the year.

While average on-chain bitcoin transaction value hovered around $5,000 in 2019, we're zooming upward to $20,000 in 2020. pic.twitter.com/ju2rR9rftU

— Jameson Lopp (@lopp) December 30, 2020

To show how heuristics can vary widely: @coinmetrics estimates (by removing likely change outputs) that $999B was transferred via bitcoin in 2020, averaging $31,660 per second. pic.twitter.com/U2LLZ1pE0g

— Jameson Lopp (@lopp) December 30, 2020

Transaction volume in terms of BTC remained rather flat during 2020. This can also be seen in blockchain.com’s chart.

As number goes up in 2020, so do the number of bitcoin addresses storing various thresholds of value. 12M addresses hold over $100 while 5M hold over $1,000. pic.twitter.com/f06byPFgJ6

— Jameson Lopp (@lopp) December 30, 2020

Distribution of bitcoin supply across addresses tends not to change much, but there was a bit of a dip in 2020 from addresses holding over 0.1% of total supply. This can likely be attributed to the exodus of bitcoin from exchanges. pic.twitter.com/ZKZHHpM5NA

— Jameson Lopp (@lopp) December 30, 2020

In terms of M1 Money Supply, Bitcoin made impressive gains.

Bitcoin rose from 34th to 13th position in terms of (2017 reported) M1 money supply during 2020. pic.twitter.com/2FuIJRwMRq

— Jameson Lopp (@lopp) December 30, 2020

From a relative historical standpoint, the overall change in exchange rate was strong.

Bitcoin average DAILY value change during:

— Jameson Lopp (@lopp) December 31, 2020

2010: +0.82%

2011: +0.76%

2012: +0.26%

2013: +1.11%

2014: -0.25%

2015: +0.09%

2016: +0.22%

2017: +0.78%

2018: -0.33%

2019: +0.18%

2020: +0.38%

To calculate the above, use the formula:

Jan 1 exchange rate * (x³⁶⁵)=Dec 31 exchange rate

Another way of showing that the bitcoin exchange rate is at an all-time high:

Number of bitcoin UTXOs that are worth less than the time at which they were created (when the value was last spent.) pic.twitter.com/e0yaBRoSKL

— Jameson Lopp (@lopp) December 29, 2020

Bitcoin Trading

P2P trading was fairly flat volume-wise.

Bitcoin trade volume was flat throughout 2020 via Bisq and Localbitcoins, though Paxful saw a decent uptick in the summer. https://t.co/n9T79DZre3 pic.twitter.com/FshNQVThxM

— Jameson Lopp (@lopp) December 31, 2020

The number of deployed Bitcoin ATMs more than doubled during 2020 to over 13,500. pic.twitter.com/qhco2ZC7HZ

— Jameson Lopp (@lopp) December 27, 2020

According to @TheBlock__'s annual report, trading volume on crypto exchanges is approaching levels not seen since the 2017 bull market. pic.twitter.com/QFPfjoFQIW

— Jameson Lopp (@lopp) December 27, 2020

BitMEX uses an insurance fund to avoid Auto-Deleveraging in traders’ positions. The fund is used to aggress unfilled liquidation orders before they are taken over by the auto-deleveraging system. The insurance fund grows from liquidations that were able to be executed in the market at a price better than the bankruptcy price of that particular position. This slowdown is probably a result of the exodus of traders from BitMEX in 2020 after the SEC took legal action against them.

After a massive 62% surge in 2019, the @BitMEXdotcom insurance fund only grew 10.5% in 2020. It now holds 0.2% of all BTC. https://t.co/GZV1nt7Ltf pic.twitter.com/eEJ4p2Xunt

— Jameson Lopp (@lopp) December 27, 2020

Bakkt open interest nears all time highs pic.twitter.com/Dy3XT4AVgo

— unfolded. (@cryptounfolded) December 29, 2020

Bitcoin balances on exchanges (this is a difficult metric to pin down precisely) appear to have dropped precipitously in 2020, back to levels not seen since February 2018. pic.twitter.com/KqGxdFhwbX

— Jameson Lopp (@lopp) December 28, 2020

Grayscale’s #Bitcoin trust hits $16.3 billion, total assets under management — $19 billion. pic.twitter.com/RHKKpUTXmC

— unfolded. (@cryptounfolded) December 28, 2020

Technical Development

At a protocol level, there was a great deal of work done in 2020. If you want a deep dive into low level developments I recommend reading Bitcoin Optech's year-in-review and Aaron van Wirdum's Bitcoin 2020 in Tech.

The Bitcoin Core repository continues to maintain its dominance as the most active.

2020 commits (excluding merges) & contributors:

— Jameson Lopp (@lopp) December 31, 2020

bitcoin core: 2,978 & 172

c-lightning: 1,918 & 46

lnd: 1,587 & 64

rust-lightning: 580 & 22

eclair: 277 & 12

blockcore: 215 & 15

btcd: 108 & 52

gocoin: 97 & 1

bcoin: 73 & 6

libbitcoin-system: 16 & 2

ptarmigan: 8 & 2

parity btc: 2 & 1

Source: calculated from the default development git branch of each repo.

git shortlog --after 2020-01-01 --summary --numbered --no-merges

Conclusion

Most people are only familiar with the exchange rate of Bitcoin, if that. But exchange rate is just one of many metrics we can use to observe the evolution of this ecosystem. While any given metric can be gamed or may be taken from sources that aren’t 100% reliable, by using a diversity of metrics and sources we can get a rough idea of the trends in this space.

2020 was the year of the first wave of big institutional players dipping their toes into Bitcoin after observing it for some time. Those of us who are dedicated to this system shall continue to BUIDL and add value; we have no control over the market but I expect that this is only the beginning of the next wave of adoption.

“Every day that goes by and Bitcoin hasn’t collapsed due to legal or technical problems, that brings new information to the market. It increases the chances of Bitcoin’s eventual success and justifies a higher price.” - Hal Finney